Have you wondered what your land is worth? The only way to truly know its value is to have hard data on market trends. Fortunately, that kind of information is available thanks to a friendship forged over 50 years ago.

Back in the mid-1960s, three Texas Aggies with a love of agricultural economics—George Cunningham, president of the Federal Land Bank of Houston, and Texas A&M University professors Dr. A.B. “Pat” Wooten and Dr. Ivan W. Schmedemann—agreed to share resources so people could have more information about land markets. It was a perfect partnership: Cunningham’s bank had information on land sales, and Wooten and Schmedemann taught real estate professionals, rural appraisers and lenders how to assess land values.

The agreement lives on between the bank, now called Farm Credit of Texas (FCBT), and the Texas A&M University Real Estate Center (REC), the nation’s largest publicly funded organization devoted to real estate research. The center tracks trends in land prices, tract sizes and sales volumes by analyzing information provided by the bank and its affiliated lending cooperatives, also called associations, in Texas and four other states.

“The research agreement allows us to do things that no other center in the country can do,” says REC Director Gary Maler. “We are always on the hunt for new ways to look at the economic drivers of real estate activity. Quality data is critical, and this is the most consistent data that exists in land markets. That’s a big deal.”

Reliable data is in demand

Landowners, real estate agents, appraisers, lenders, tax accountants, estate planning attorneys and others are hungry for market information that is accurate, current and objective.

“We look at everything that moves through the market,” says Dr. Charles Gilliland, the center’s rural land expert. “There are a lot of dynamics going on beneath those numbers. Sometimes we see a trend before the guys on the ground notice anything.

“It’s a unique situation. Most of the data at other universities is based on opinion, on surveys.”

One reason the information is in such demand is because sales prices are not publicly disclosed in some states—including Texas.

One reason the information is in such demand is because sales prices are not publicly disclosed in some states—including Texas.

“In a nondisclosure state, it can be extremely difficult to get verified information about prices,” says Jeff Royal, collateral risk manager for Lone Star Ag Credit, a Farm Credit lending co-op based in Fort Worth. Even in disclosure states, sales data isn’t routinely gathered in one place.

To bridge the gap, the REC analyzes data from transactions financed by Farm Credit associations, which have a large market share of rural real estate mortgages. The lenders supplement that with leads from real estate agents, appraisers and Lands of America, the country’s largest rural property listing network.

The meaning behind the numbers

The decades of data have provided valuable insight into consumer behavior and land market drivers such as oil prices, personal income and interest rates.

As technology evolves, researchers look at the numbers in new ways.

Currently, the center is using geospatial analysis to map sales activity that has been shifting toward counties with lower priced land as buyers look for a good deal. It also can correlate market trends with land use, housing activity, flood zones and other factors.

Gilliland admits he’s fascinated by the way dynamics constantly change, like when demand for sand mining temporarily sent land prices into orbit in parts of Far West Texas last year.

“That’s why we use median prices,” Gilliland says, describing just one way the center keeps seasonal, regional and other variations from distorting the big picture. “If you do an average, a great big number makes a great big difference, but a median is based on a ranking from highest to lowest. It’s more indicative of what is typical for the region.”

The partnership is a win for Farm Credit and a win for the center, which has a mission to help people make better real estate decisions.

“We’re exchanging our expertise for access to data,” Maler says. “The benefit isn’t just for us. Healthy markets are good for everybody. We’re aggregating data so folks have some guidance on prices.”

Why land value trends matter

Understanding behavior

Data can clue you

Searching for property

Market data can help buyers narrow their search based on region, budget

Financial planning

Land values are one measure of overall wealth. “If you keep up with the trends, you’ll have an idea of what your property is worth and how it’s changed over time,” Gilliland says. “There are all kinds of ways that can impact you from a business standpoint. One is your tax situation—both inheritance taxes and the market value that local authorities are assigning to your property for property taxes.”

Appraising accurately

Appraisers look at sales in the area to arrive at a property’s current value. “The reports from the Real Estate Center can reinforce that by verifying trends in the market,” says Royal of Lone Star Ag Credit.

Making loans

Lenders monitor collateral’s value so they can maintain healthy loan portfolios. In Texas, Farm Credit associations use indexing based on the Real Estate Center’s sales analysis, which is much more objective than using survey data or benchmark appraisals. “Benchmarking hinges on appraising a typical property from a market area, but a typical property is very hard to find, when you get right down to it,” says Brad Swinney, FCBT vice president of collateral risk management. “Our unique relationship with the Real Estate Center helps us exceed what we could do benchmarking.”

A look back at rural land value trends

The Texas A&M University Real Estate Center analyzes land sales data and publishes median price, tract size, sales volume and the rate of change on its website.

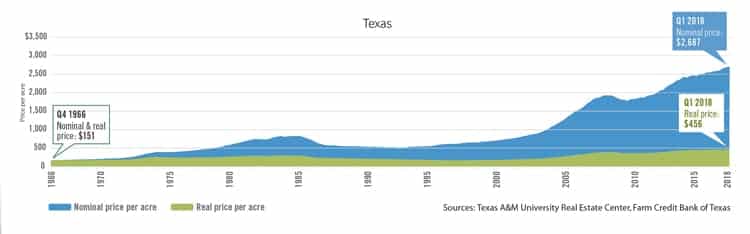

In these statewide four-quarter moving average prices, nominal price (top line) reflects dollar amounts at that time, and real price (bottom line) is adjusted for inflation back to the first year the data was collected.

“Real prices indicate whether current prices are high or low from a historical standpoint,” says Dr. Charles Gilliland of the Real Estate Center. “If you buy land today in Texas, real prices are telling you that a typical acre of land will cost you more than it would have at any time since 1966.”

For Texas land market data, go to www.RECenter.tamu.edu and click on Rural Land under the Data tab.