This article is featured in the Spring 2025 issue of Texas LAND magazine. Click here to find out more.

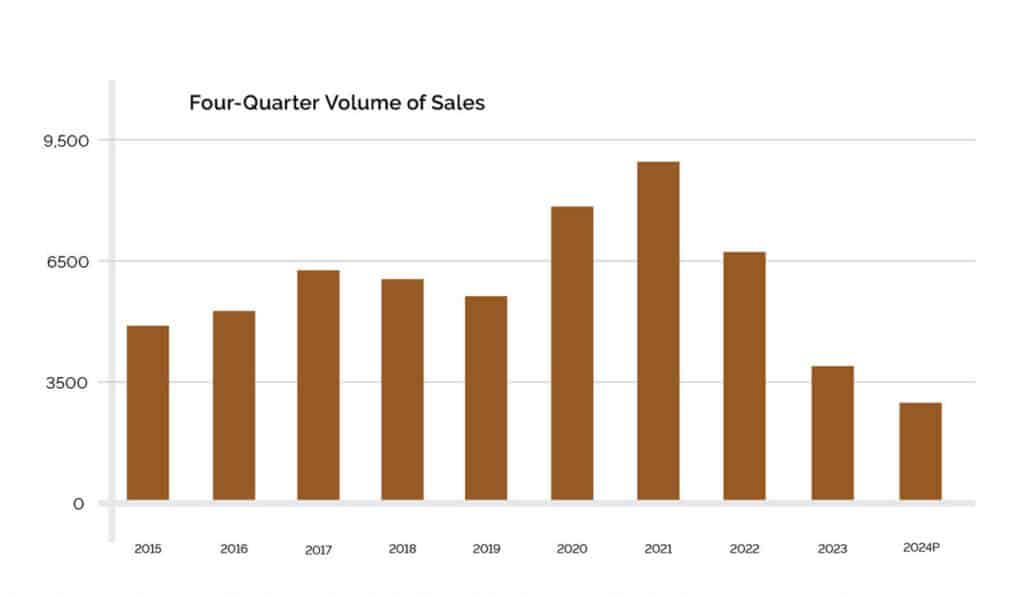

- Total Dollar Volume $1.35 Billion

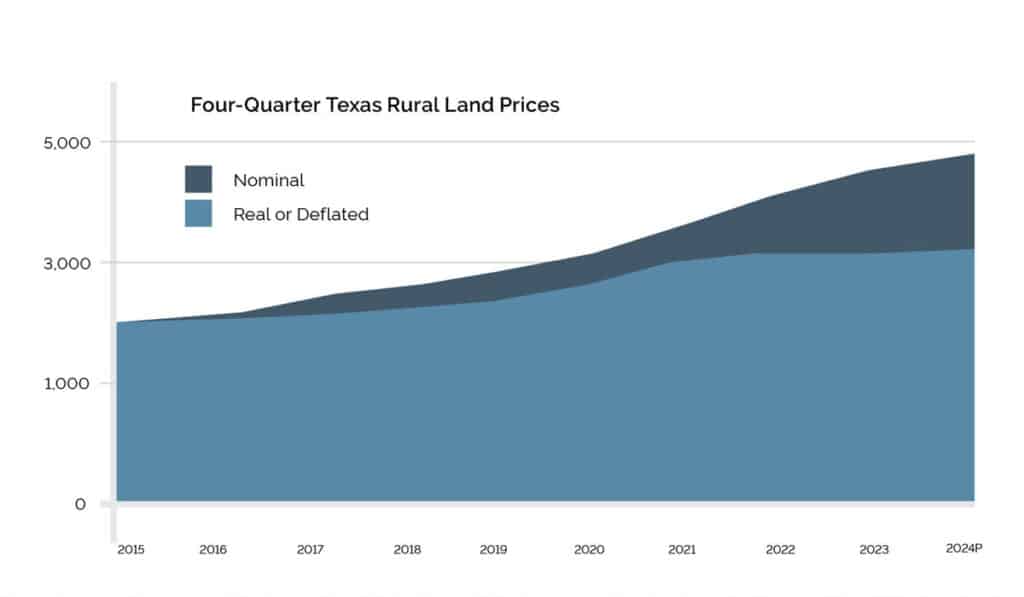

- Price Per Acres Increased to $4,751

- Sales Dropped from 2023 10.3%

- The Number of Acres Increased 284,886

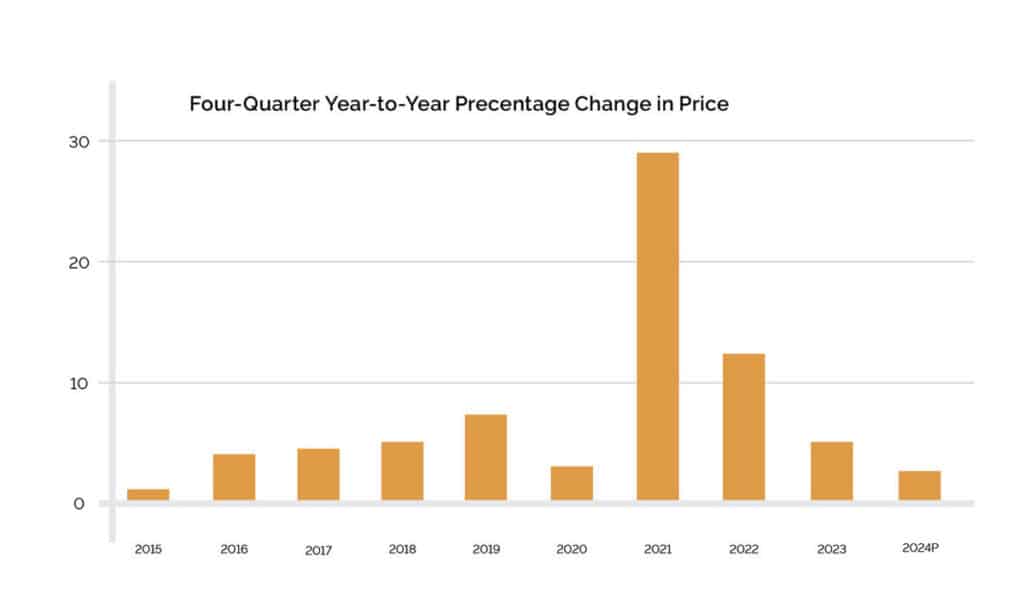

The slowdown in sales volume continued with preliminary 2024 sales dropping 10.3 percent from 2023 totals to 3,161 sales. That volume posts a 62 percent retreat from the 8,350 sales reported in 2021 and is well short of the 4,849 sales booked in 2015. However, the number of acres increased to 284,886, a 6.2 percent rise above 2023 totals. Total dollar volume also increased 7.62 percent to $1.35 billion as price continued to increase a meager 1.34 percent to $4,751 per acre. The increases in acreage and total dollar volume suggests that the decline in sales activity may be approaching an end. H owever, regional trends varied.

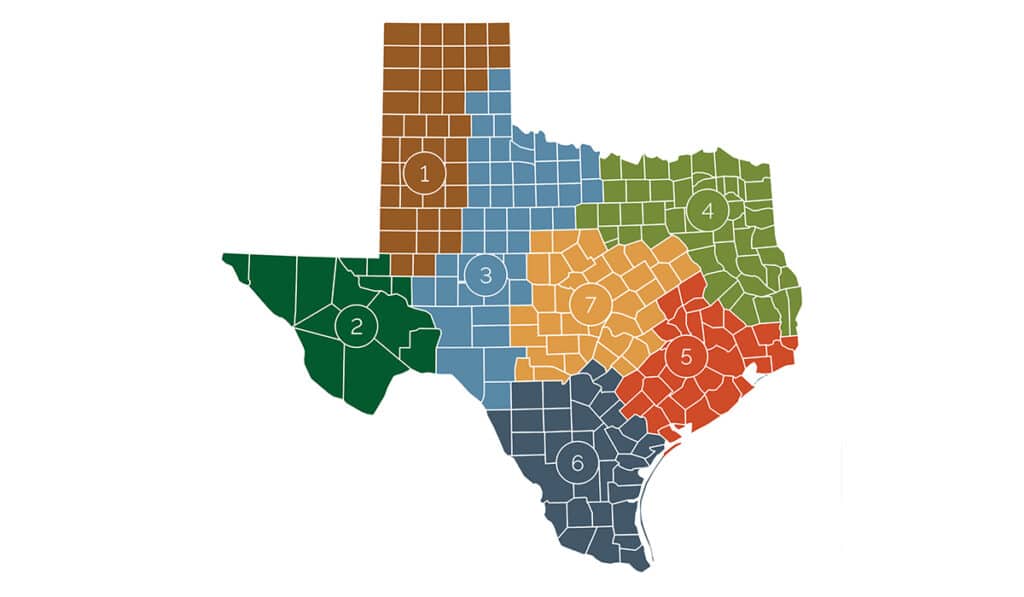

- Panhandle & South Plains. Prices in this region increased 4.3 percent to $1,751 per acre with the number of acres dropping 18.5 percent to 318 sales totaling 48,875 acres. However, the number of sales faltered, declining 10.4 percent to 318 sales. Total dollar volume also slipped in this region, falling 15.0 percent to $87.7 million. The slow volume and dropping total dollar volume suggests the market remains weak.

- Far West Texas. Price increased to $616 per acre, a 5.1 percent increase. The region reported only 10 sales for the four-quarter period, down 35.4 percent. Typical size was 18,002 acres.

- West Texas. West Texas prices recovered some momentum, up 4.0 percent to $2,507 per acre. However, sales volume expanded in this region, rising 10.7 percent to 455 sales. Total acreage grew 13.0 percent to 70,809 acres with total dollar volume expanding 17.5 percent to $177.5 million.

- Northeast Texas. Prices in this region continued to rise, up 2.1 percent to $8,331 per acre. However, the higher prices continued to depress volume with the 731 sales marking a 33.8 percent drop from 2023. A total of 22,031 acres sold, a decline of 39.8 percent. The drop in volume pushed total dollar volume down 38.5 percent to $183.5 million.

- Gulf Coast–Brazos Bottom. Prices in this region reached a record high at $10,028 per acre, up 4.7 percent. Volume slipped down 4.2 percent to 453 sales. However, total dollar volume inched up 6.4 percent to $183.0 million. Total acreage also rose 1.6 percent to 18,250 acres.

- South Texas. South of San Antonio prices dropped 6.4 percent to $5,815 per acre, but sales volume expanded 2.8 percent to 297 sales. With total acreage climbing 8.4 percent to 23,009, total dollar volume remained nearly steady, rising a mere 1.5 percent to $133.8 million.

- Austin-Waco-Hill Country. Prices increased 2.5 percent to $7,310 per acre. The number of sales expanded 2.3 percent to 897 transactions. However, total dollar volume grew by 11.1 percent to $331.2 million. Total acres rose substantially, up 8.4 percent to 45,301 acres.

The Future

Despite price increases in six regions and strengthening total dollar volume, statewide prices barely rose. The aftermath of the buying frenzy appears to be settling into a more orderly market. Economic conditions appear to be stabilized with most observers foreseeing a modestly positive year ahead. Land prices appear to have reached a plateau.