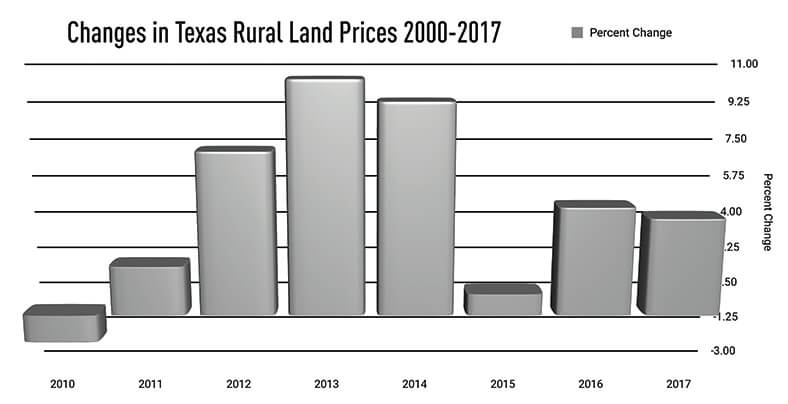

Texas land markets posted a surprisingly strong fourth quarter as oil prices rose and drilling activity rebounded. From far west Texas where frac sand suppliers paid premiums for ranches to south Texas, large price increases prevailed. Those developments counteracted emerging weakness in cropland areas and a flat central Texas market to post a statewide price of $2,644 per acre. That price represented a respectable 4.46 percent rise over 2017 prices, the strongest growth since 2014. At 6,272 transactions, sales volume also outpaced 2016 results by 577 sales. These results indicate that Texas statewide land markets continued to thrive overall. Even the Gulf Coast region, thrashed by hurricane Harvey in the third quarter posted a rise in prices. However, market conditions varied from these healthy outcomes in some regions where decidedly challenging conditions produced weak results. The Panhandle and South Plains and West Texas regions saw prices significantly decline while prices in the Austin-Waco-Hill Country area retreated modestly.

As the year opened, virtually all observers forecast rosy scenarios for the year ahead. The economy was firing on all cylinders and oil prices appeared to have stabilized at higher levels. The income tax reform promises to fill pockets with more cash to spend. Employers scramble to hire more help. Despite political distractions, reduced regulation has engendered a spirit of optimism among business owners. Just when everyone felt giddy, the stock market took a dive and possible problems with subprime lending for automobiles sent sobering negative signals. Yet, nothing fundamental has change from the conditions inspiring the rosy outlook. On balance, the way forward for this coming year looks optimistic for most land markets. However, cropland may finally encounter the headwinds that low commodity prices normally bring to bear.