This article is courtesy of FCS Financial. Visit www.myfcsfinancial.com to find more about financing your agribusiness, ranch, farm or rural recreational property purchase.

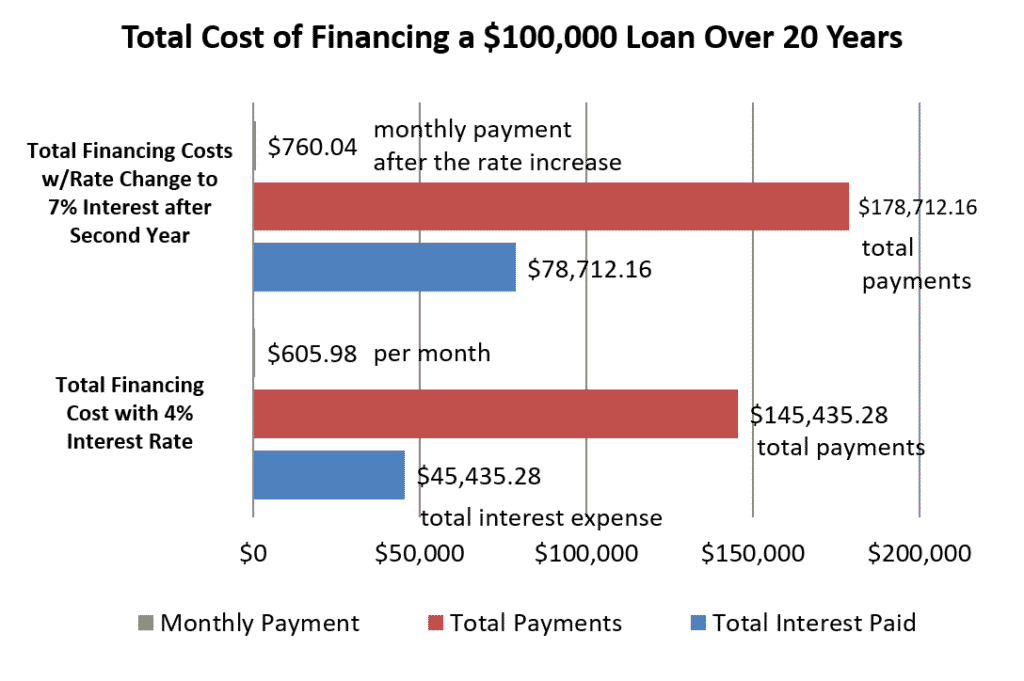

Buying rural property, whether it’s land, a farm, or a house in the country, is a major undertaking. You have several choices when deciding about the type of interest rate you want. We want to make sure you understand your interest rate options, so we explain the different interest rate types on our website. Above we show you the mathematical difference between a fixed and variable interest rate.

In this situation, the applicant is financing $100,000 land purchase that they will repay monthly for 20 years. The top scenario uses an adjustable interest rate where the rate is a 4% for two years and adjusts to 7% after the second year. The bottom scenario is a 4% fixed rate for the length of the loan which is 20 years. You can see how much more the applicant will spend based on the interest rate change.

Complete this form to receive the information above as a downloadable PDF.

FCS Financial specializes in rural property and agricultural financing. We understand this is a big decision and are happy to answer any questions you have, even before you are ready to obtain financing. Find more information about financing land at myfcsfinancial.com or contact an FCS Financial lending specialist at 1-855-507-276.