The results are in from our 2016 Land Market Outlook survey. Nearly 1,000 land buyers, sellers, and brokers sent in their assessment of the current and future of land markets. Land buyers and sellers were in agreement for every question presented and remained optimistic as a whole towards the future of land markets. The questions included the assessment of land values, both near-term and long-term, land inventory on the market, and expected sales. These results have been broken out by state for more regional insight into buyer and seller differences. A full report will be available for download soon, this is just a partial result set. Thank you to all who participated!

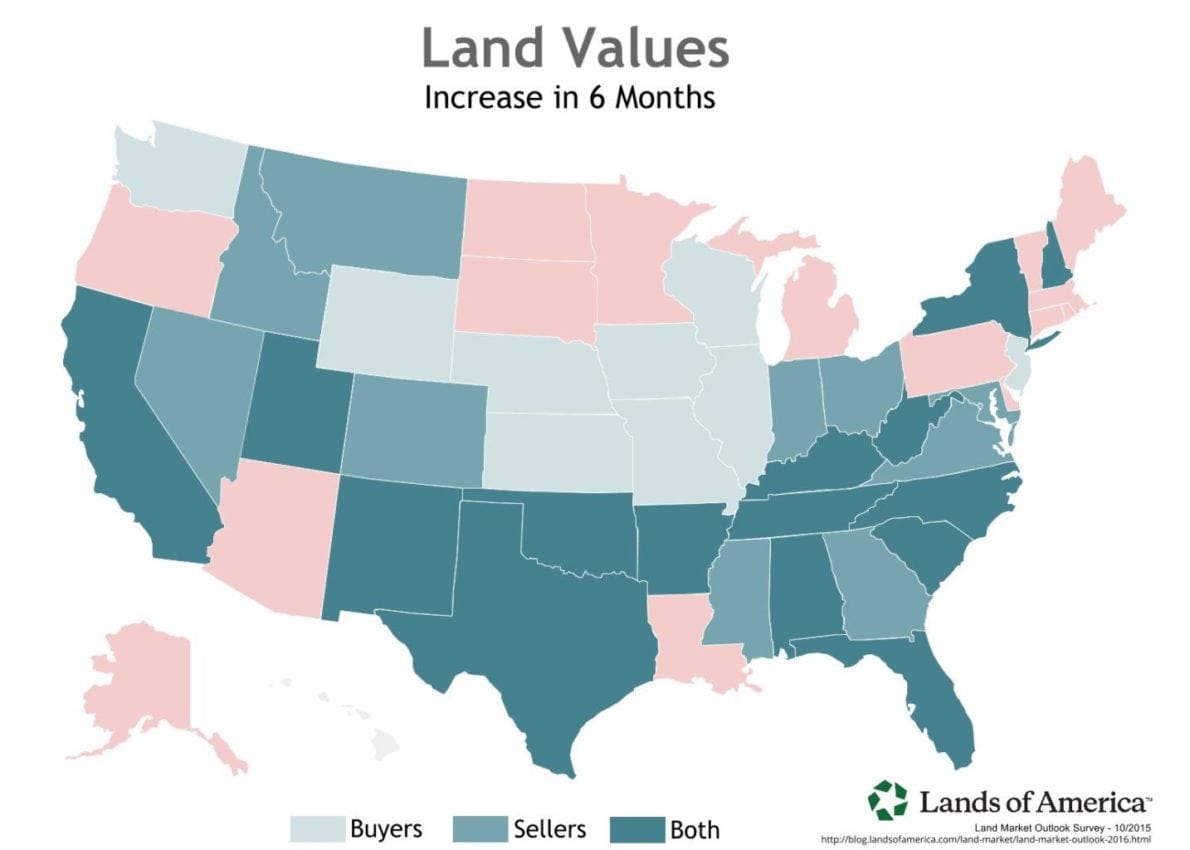

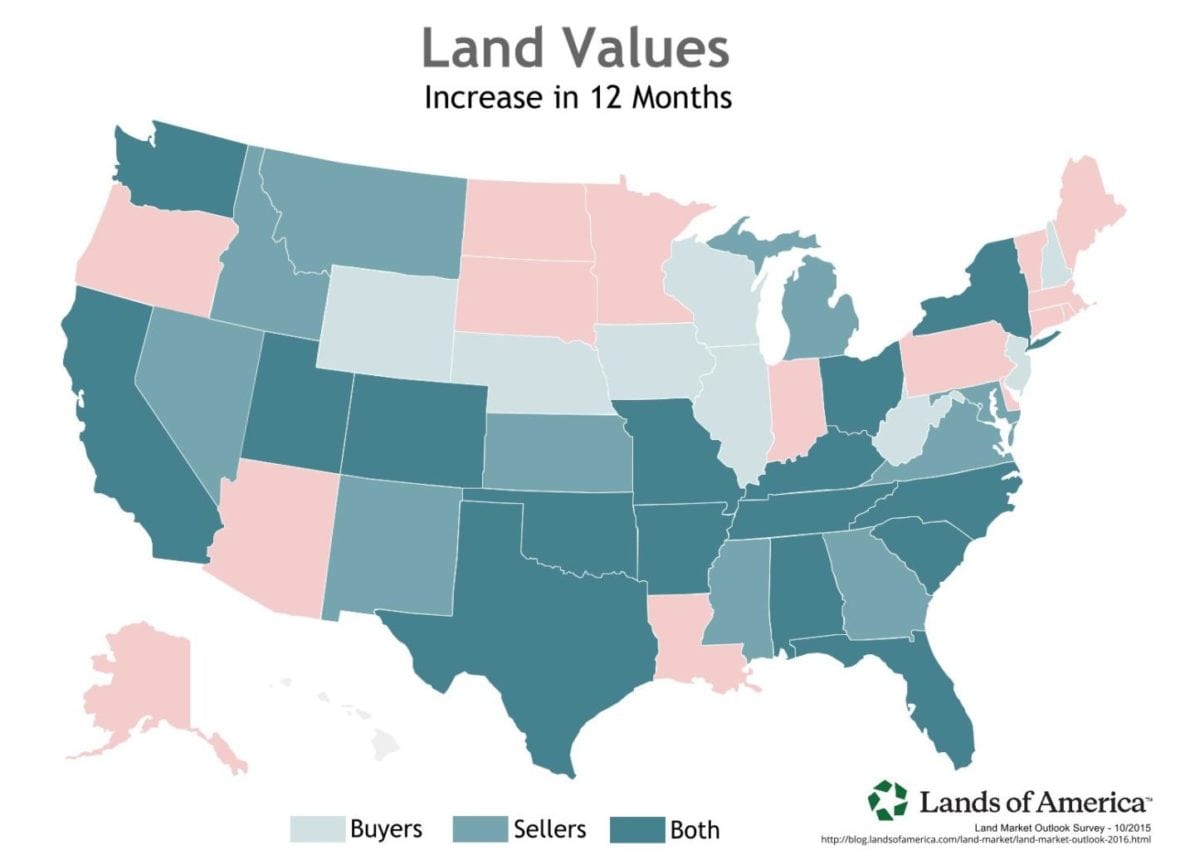

Just more than half of land buyers and sellers predict an increase in land values over the next six months, with the southern states seeing the most confidence and overlap. Buyers foresee an increase up through most of the Midwest, while land sellers are focused on the Southeast, Montana, Idaho, and Nevada. Several states (in pink) have been excluded from price increases either due to low numbers of respondents, or split results. It is important to note that some states may show both a projected increase and decrease in values because of different opinions from buyers and sellers.

The land values of hunting properties in Michigan have been basically flat for past 3 years. Have seen increase in farm ground, but would think that will be dropping soon due to lower commodity price.”

-Land Broker from Michigan

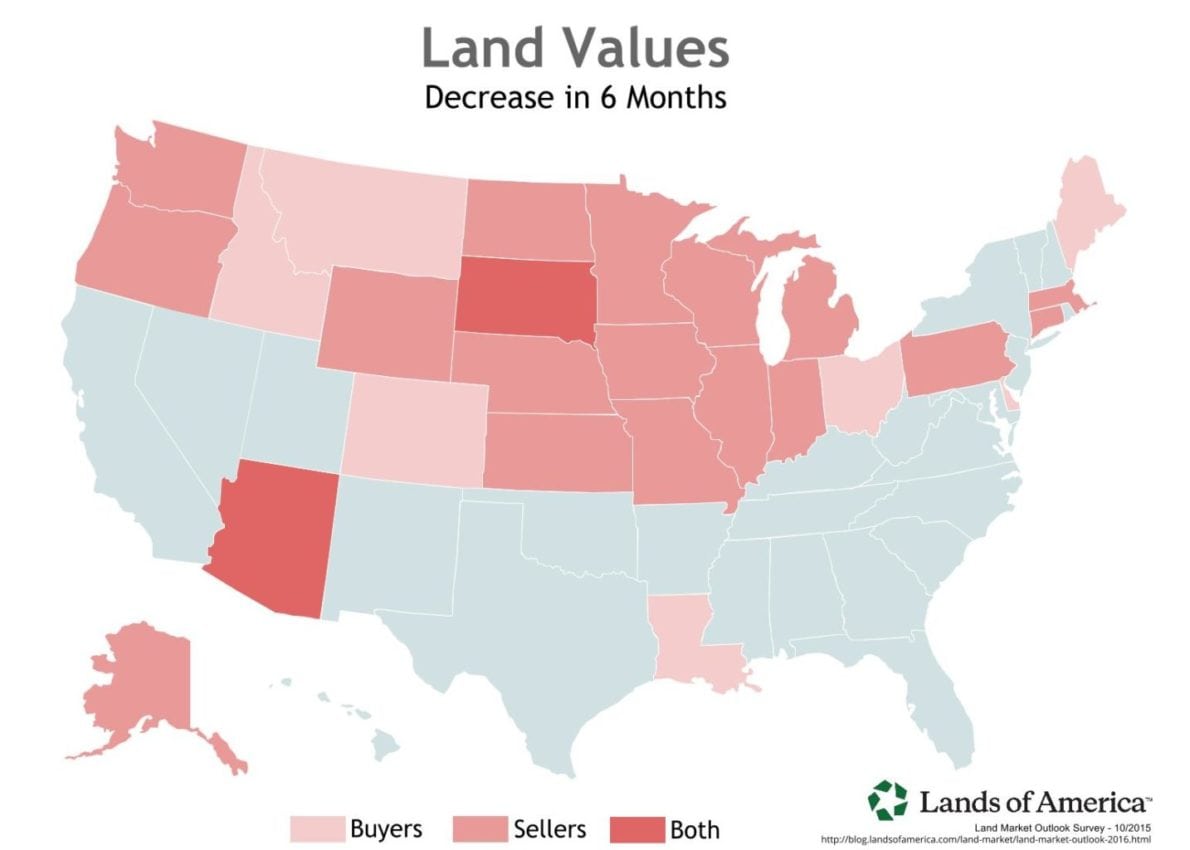

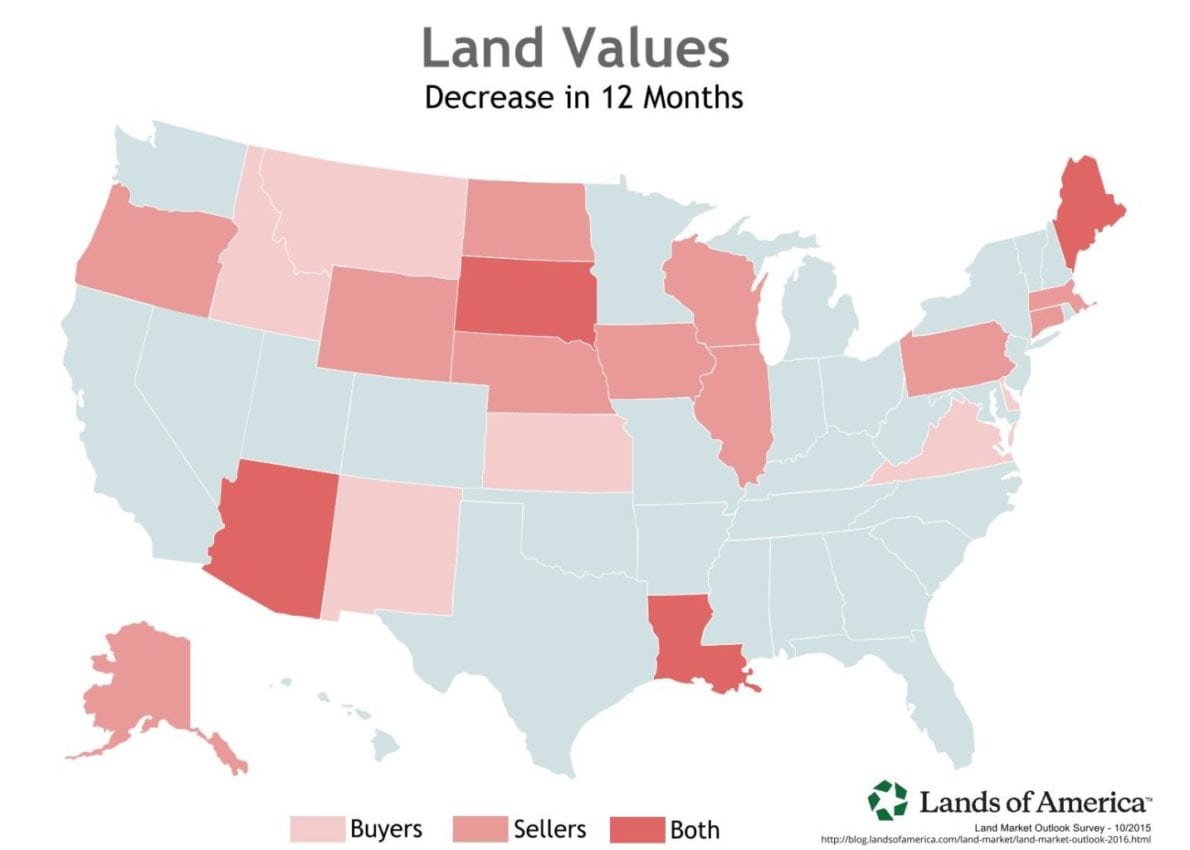

It was clear that the north was where price decreases in the next six months were most likely to take place, although land buyers and sellers didn’t agree on which states would see the decrease. Arizona was the lone standout in the southern US with both buyers and sellers agreeing on a near-term land value decrease, and Louisiana favored to see a decrease by buyers. This was the clearest line of distinction in the series, even with the separation between groups.

With lower grain and livestock prices, I look for set back in land values. I think this trend will continue for a year or so. Could be a good buying opportunity.

-Land Seller from Kansas

Beans aren’t $18 any more. Corn isn’t $8 any more. This causes people to sober up a little. The return isn’t what it was.

– Land Seller from Arkansas

A greater majority of respondents predicted an increase in prices over the next 12 months, up approximately 3% over the first 6 months. Although more scattered, there was much more of a consensus between land buyers and sellers on which states would see land price increases in the next 12 months. A full 16 states had price increase agreement between groups, while only 15 states were missing a majority vote or stalemated among respondents. Louisiana and Arizona were the only two in the south which didn’t foresee a 12 month price increase.

Sellers are still in the 2006-2007 mindset. Buyers are still looking for bargains. I see unrest in the land market, a wait and see for buyers.

-Land Broker from Georgia

While a larger majority of both buyers and sellers predict an increase in prices overall, a few states bucked that trend. Louisiana, Arizona, and South Dakota all were predicted to have lower prices over 12 months by both buyers and sellers. The rest were fragmented among various regions, split by land buyers and sellers, but found primarily in the Midwest and Northwest.

We have seen the best there is behind us. As incomes drop, potential buyers drop and values will follow.

-Land Buyer from Texas

Land Markets in general, will stabilize, but where there are areas of more leverage the price of farm land will decrease. There are buyers to buy at lower prices.

-Land Broker from Montana

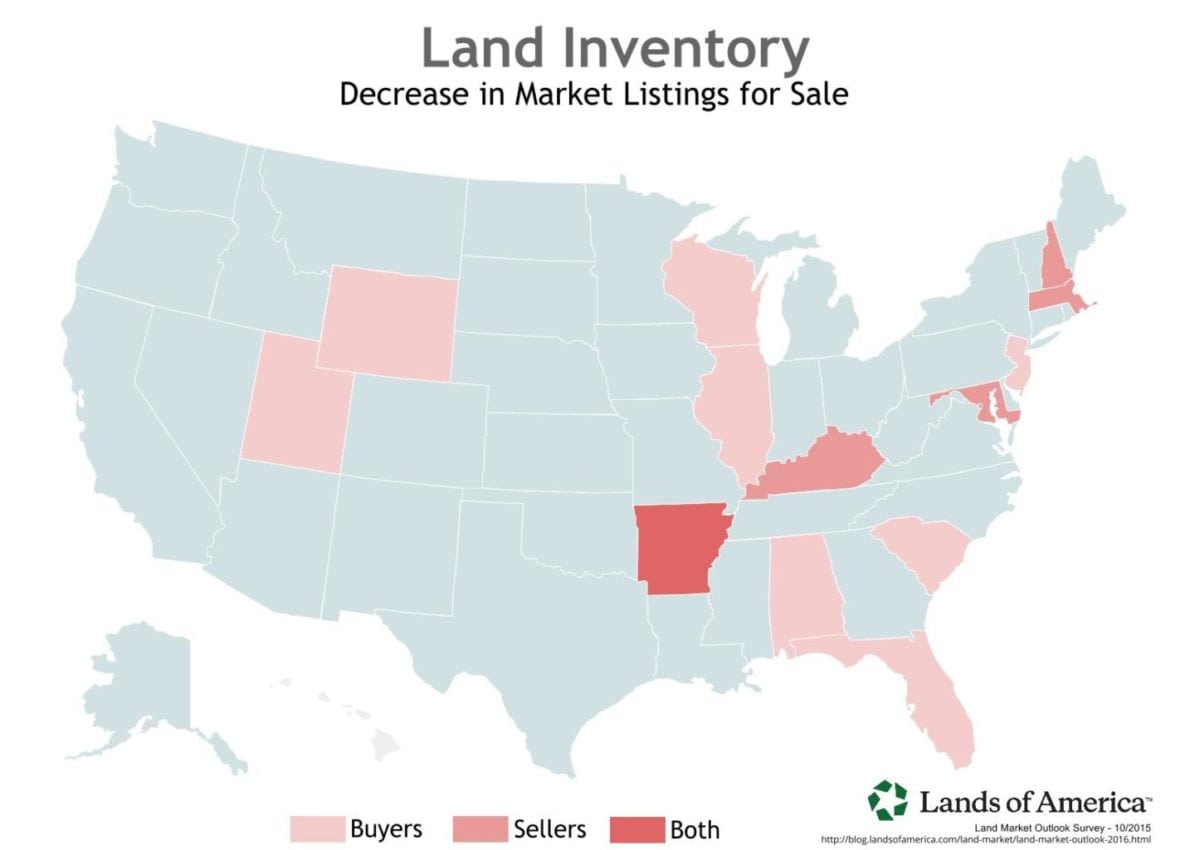

Both land buyers and sellers strongly agreed that there would be an increase of land on the market in the next 12 months with about two-thirds of respondents predicting an increase in market inventory. Since there were far fewer states showing a decrease, it made sense to highlight them for a clearer picture. Only a few scattered states had more respondents predicting a decrease in of land properties over this year, with the only overlap for buyers and sellers landing in Arkansas.

Lower quality farms are beginning to come to the market. Thus prices will appear to fall more than the real market.

-Land Broker from Arkansas

The market will face a tough time as the number of premium properties decrease.

-Land Buyer from Oklahoma

While we were very happy to have nearly 1,000 responses, this low number limits the statistical significance of the survey, especially in the regional data. This survey does not reflect actual market conditions or influences, and should only be used as a representation of market sentiment from those surveyed. Subscribe to our Market Reports Newsletter to keep up on market conditions in your area.

Real estate will continue to become a good asset for investors to include and to hold in their investment portfolio.

-Land Buyer from Texas

Do you share their opinion, or do you have a different take on the market? Let us know in the comments below!