This article is featured in the Winter 2021 issue of Texas LAND magazine. Click here to find out more.

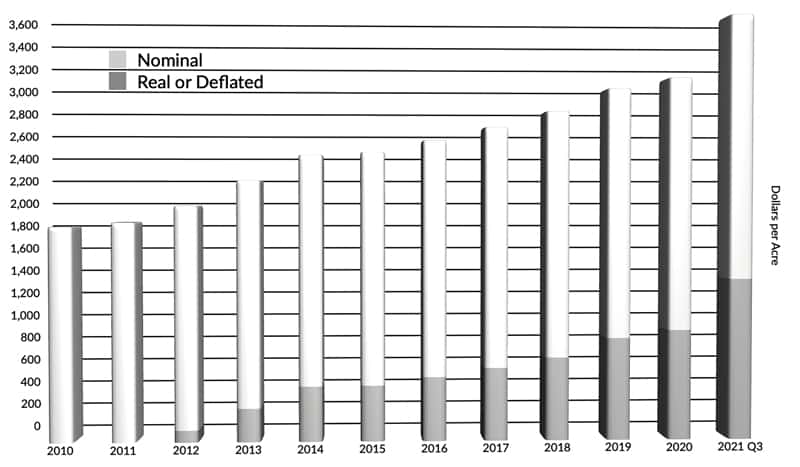

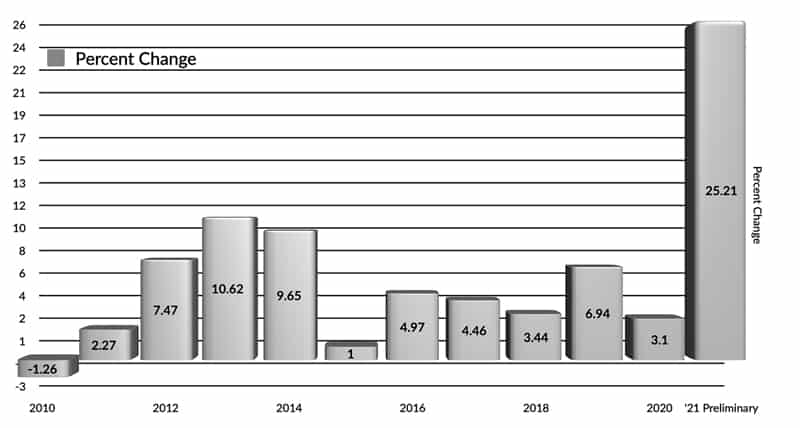

Preliminary third quarter reports indicate continued growth in sales volume up 31.99 percent to a total of 8,789 sales. However, quarter-to-quarter comparisons suggest that growth slowed from the second quarter 2021 levels, suggesting a deceleration in the feverish pitch of the market. That slowing of the rate of growth may signal some push back on high asking prices, however it may also reflect a shortage of listings. Prices soared an amazing 25.21 percent to $3,725 per acre statewide.

All regions experienced double digit price increases with most regions posting substantial increases in the total acres transferred. Market participants reported an abundance of investment-motivated buyers competing with recreational buyers and urban dwellers seeking a countryside retreat. In addition, farmers and ranchers have enjoyed increases in commodity prices, fueling demand for cropland. This strong base for demand propelled Texas markets to a new record in total dollar volume at $2.77 billion, a 104.55 percent increase over 2020 third quarter totals. At 743,425 acres, total land transfers increased 63.37 percent. This continues to be one of the most active periods in Texas land market history. The typical size dropped 0.78 percent to 1,236 acres.

Panhandle and South Plains: Activity moved up only 9.24 percent, moving prices 12.13 percent higher to $1,257 per acre. This increasing trend resulted from 127.25 percent increase in total acres sold, a total of 137,447 acres. Dollar volume increased 154.82 percent to $179.3 million.

Far West Texas: Although activity in the oil patch has picked up, it still has not inspired buyers in this market where total acreage dropped 44.03 percent to 25,068 acres. However, prices continued at unprecedented high levels at $1,608 per acre up 171.62 percent. The number of sales dropped 14.38 percent to 21 sales. The few sales at very high prices makes it difficult to establish reliable pricing information.

West Texas: Sales activity increased 52.16 percent with a 12.26 percent price increase to $1,886 per acre. Total acreage sold exploded up 110.05 percent to 196,661 acres, driving a 135.08 percent increase in total dollar volume to $370.9 million. Extremely strong demand is driving prices higher.

Northeast Texas: Volume of sales expanded 21.47 percent, pushing prices up to $6,245 per acre, a 26.88 percent increase. Total acreage increased 26.09 percent to 93,099 acres. Rising prices and increasing acreage drove total dollar volume up 59.99 percent to $581.4 million. Markets reflect continued strong demand throughout the entire region

Gulf Coast – Brazos Bottom: The volume of sales ramped up 46.64 percent from 2020 with total acres sold increasing 28.24 percent. Prices increased a remarkable 19.25 percent to $7,906 per acre. The high price and expanded total acreage produced a 52.92 percent increase in total dollar volume to $365.7 million.

South Texas: Sales activity increased substantially in the region south of San Antonio, rising 57.12 percent to 806 sales. Prices grew 20.03 percent to $4,627 per acre while total acreage expanded by 102.53 percent to 86,926 acres. This activity drove total dollar volume up 143.09 percent to $402.2 million.

Austin – Waco – Hill Country: Prices in central Texas soared 29.25 percent to $5,259 per acre. In addition, sales volume increased 28.95 percent. Strong demand expanded total acres sold by 51.17 percent to 152,745 acres. This activity drove total dollar volume up 95.38 percent to $803.3 million.

The Future: The stampede to the countryside continued in the third quarter. Investors joined the throng of buyers motivated by the desire to escape cities. In addition to those buyers, farmers and ranchers also have entered the markets. Many observers fear that market activity at these levels cannot last and some brokers report some reluctance to pay asking prices. Nevertheless, brokers also report multiple offers at prices that exceed asking prices for many properties. Thus, nothing on the horizon points to a diminution in demand for land in the countryside. The coming months will likely see a continuing scramble for land with increasing upward pressure on prices. At some point, this feverish demand may wane, but that time has not yet arrived.