This article is featured in the Spring 2022 issue of Texas LAND magazine. Click here to find out more.

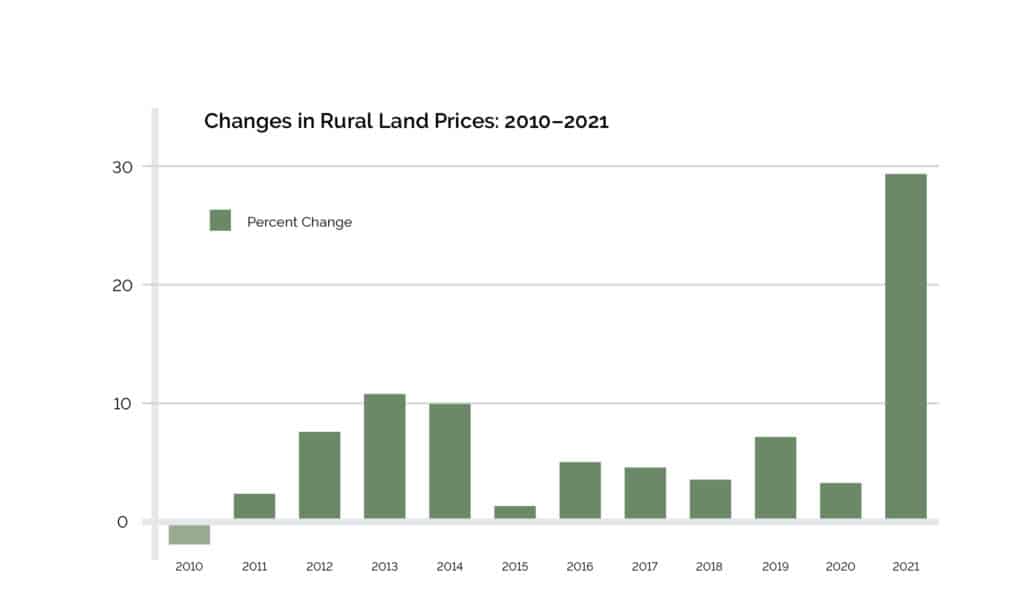

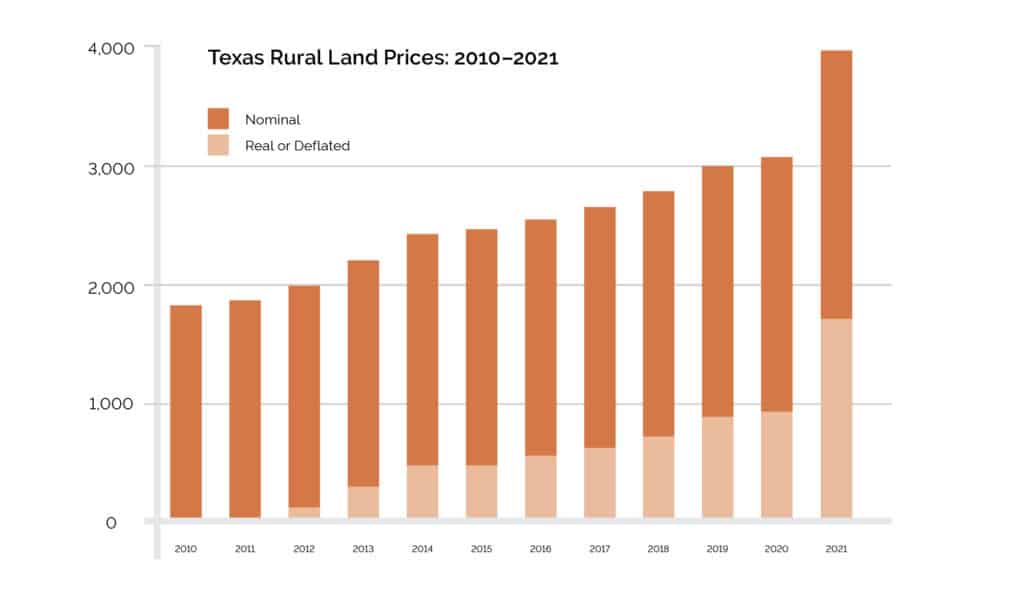

Preliminary fourth-quarter reports indicate continued explosive growth throughout the Texas market. Total acreage shot up 49.47 percent to 826,127 acres. Final reports will further expand that total making 2021 a record-breaking year with dollar volume reaching $3.27 billion, a 92.89 percent increase over 2020 levels. That total will expand further when the final reports add sales. The statewide price soared an amazing 29.05 percent to $3,954 per acre.

All regions experienced double-digit price and total acreage percentage increases. Market participants reported an abundance of investment motivated buyers competing with recreational buyers and urban dwellers seeking a countryside retreat. In addition, farmers and ranchers have enjoyed increases in commodity prices fueling demand for cropland. This continues to be one of the most active periods in Texas land market history. The typical size increased 14.58 percent to 1,305 acres.

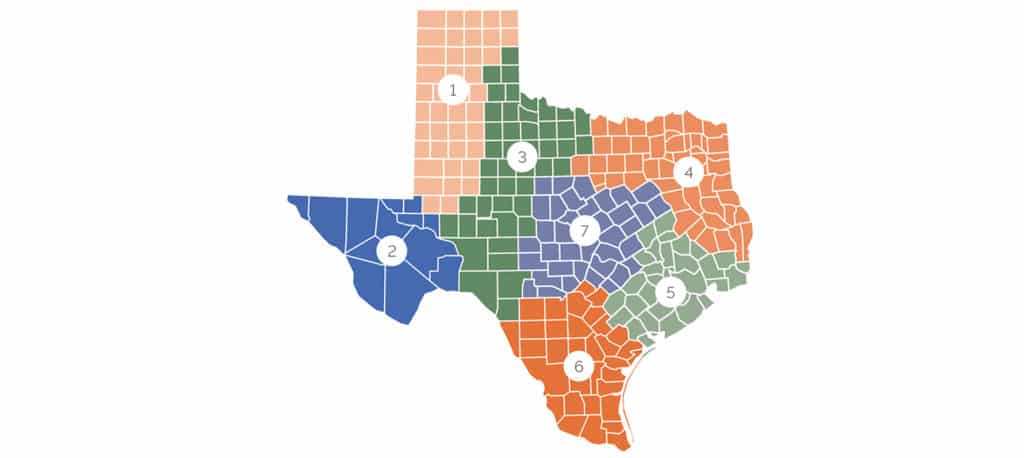

- Panhandle & South Plains. The number of sales increased 7.55 percent while prices grew 22.64 percent higher to $1,338 per acre. Total acres sold grew 28.14 percent to 146,696 acres while dollar volume increased 57.15 percent to $196.3 million.

- Far West Texas. Although rising oil prices have inspired an uptick in the oil-related operations, the expansion has not prompted buyers to flood into this market where only 21 total sales represented an 18.61 percent drop from 2020 levels. However, total acreage expanded by 10.95 percent to 39,091 acres. Buyers concentrated on highly desirable properties driving prices up 96.34 percent to $1,826 per acre. Few sales at very high prices make it difficult to establish reliable market-wide pricing information.

- West Texas. Sales activity increased 23.21 percent to 1,009 sales and a 17.14 percent price increase to $1,941 per acre. Total acreage sold exploded up 86.22 percent to 227,090 acres. At $440.8 million total dollar volume soared 117.85 percent over 2020 levels. Strong demand fueled higher prices.

- Northeast Texas. Volume of sales rose 12.15 percent while prices increased 31.97 percent to $6,646 per acre. Total acreage increased 25.79 percent to 102,064 acres. Rising prices and increasing acreage drove total dollar volume up 66.01 percent to $678.3 million. Markets reflect continued strong demand throughout the entire region.

- Gulf Coast–Brazos Bottom. The volume of sales ramped up 16.37 percent from 2020 with total acres sold increasing 45.86 percent. Prices increased a substantial 23.75 percent to $8,523 per acre. The high price and expanded total acreage produced an 80.50 percent increase in total dollar volume to $446.4 million.

- South Texas. Sales activity increased remarkably in the region south of San Antonio where 95,673 acres comprised a 90.54 percent increase over 2020 totals. Prices grew 19.11 percent to $4,668 per acre. The number of sales expanded by 29.46 percent to 791. This activity drove total dollar volume up 126.95 percent to $446.6 million.

- Austin-Waco-Hill Country. Prices in central Texas topped 2020 prices by 37.80 percent, rising to $5,738 per acre. In addition, dollar volume mushroomed up 97.57 percent to $936.1 million. The strong demand fueled a 43.37 percent expansion in total acres sold to 163,136 acres.

The Future

The insatiable demand for rural property continued in the fourth quarter. Investors, a throng of buyers motivated by the desire to own rural retreats, and farmers and ranchers continue to compete for available properties.

Many observers fear that market activity at these levels cannot last. Nevertheless, brokers continue to report multiple offers at prices that exceed asking prices for many properties. Thus, nothing on the horizon points to a diminution in demand for land in the countryside. The coming months will likely see a continuing scramble for land with increasing upward pressure on prices. At some point, this feverish demand may wane, but that time has not appeared on the horizon.