This article is featured in the Winter 2024 issue of Texas LAND magazine. Click here to find out more.

- Total Dollar Volume $1.3 Billion

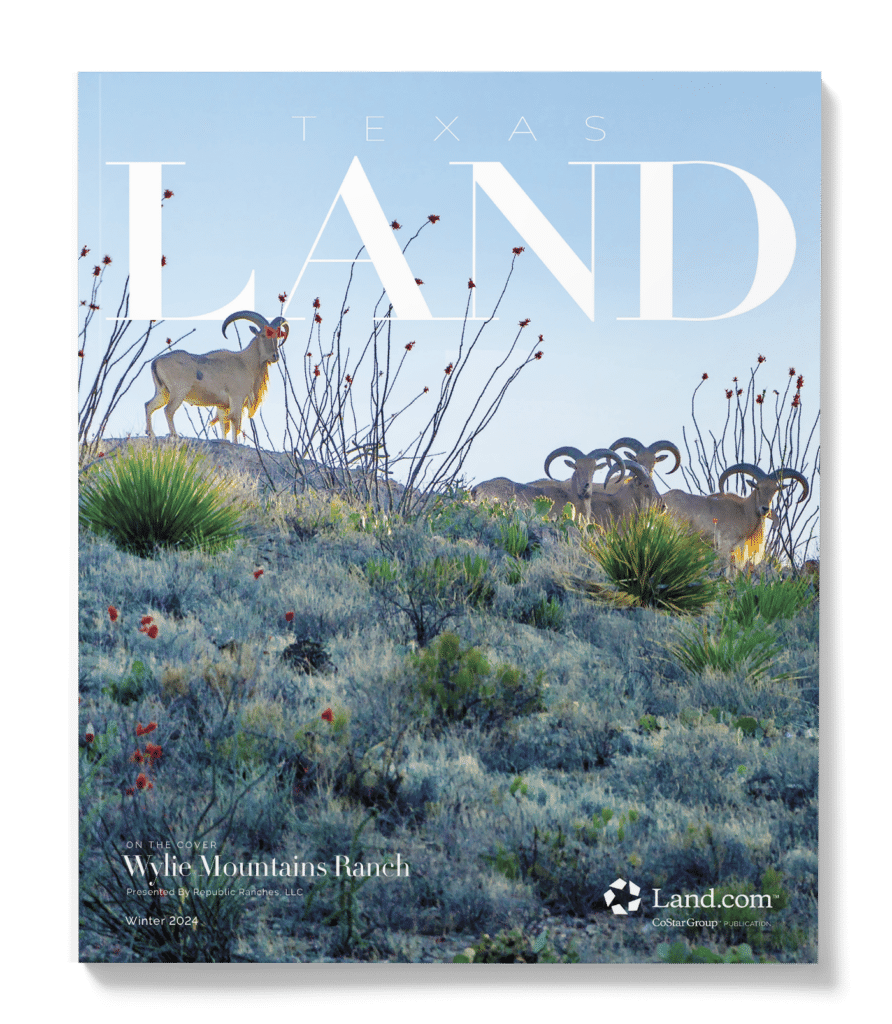

- Price Per Acres Increased to $4,752

- Overall Volume Dropped 11.3%

- The Number of Acres Lagged to 280,112

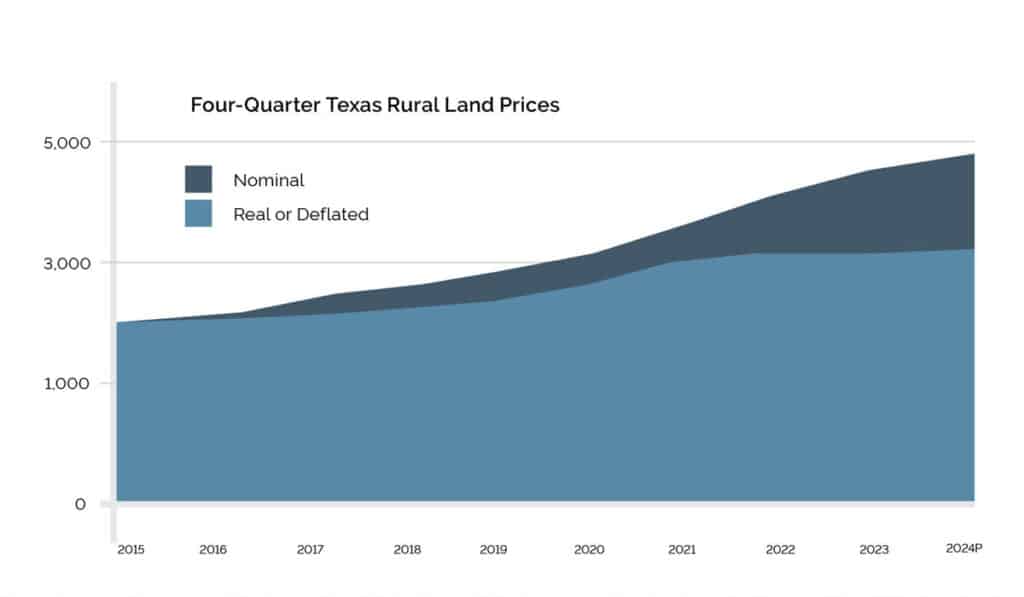

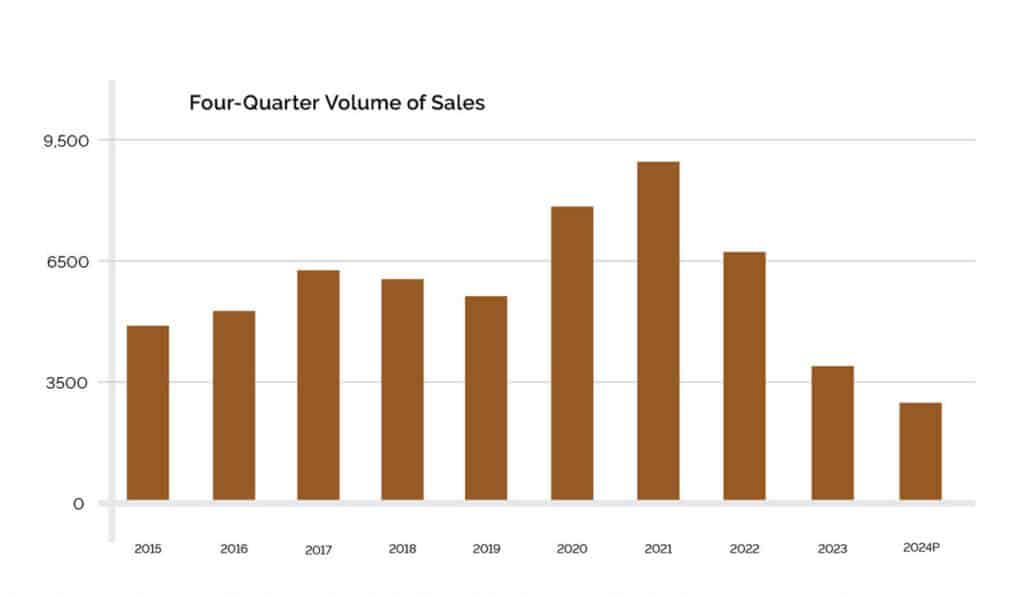

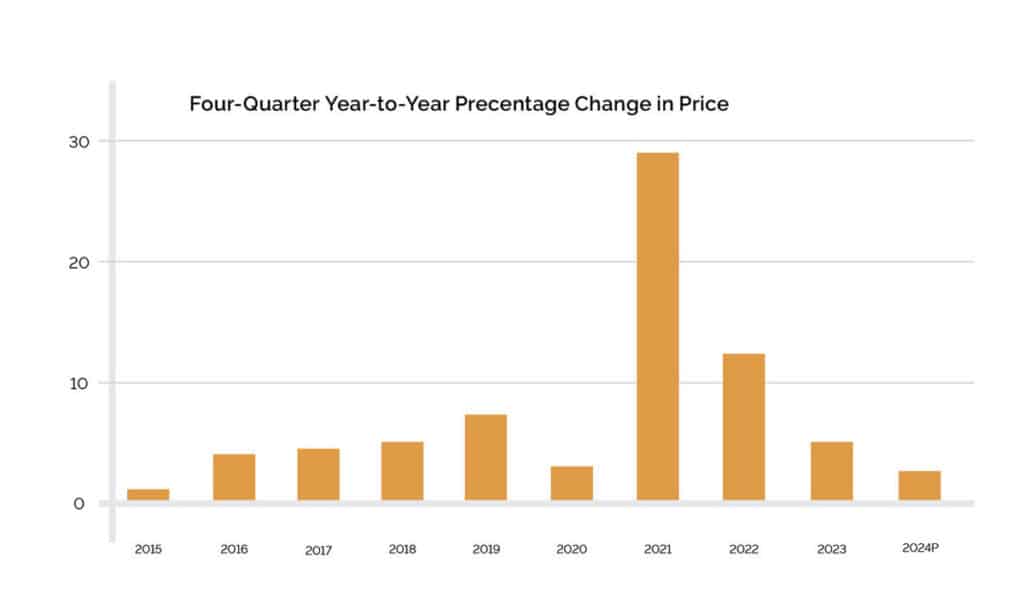

The retreat in the volume of sales has slowed with number of sales in the four quarters ending in September 2024 at 3,282 falling only 11.3 percent from the 2023 totals of 3,699, but 63.8 percent below the 2021 volume of 9,055 transactions. (Note: the third quarter numbers are preliminary. Final numbers on volume will narrow the declines in volume somewhat.) The number of acres at 280,112 lagged 2.8 percent from the total in 2023 with total dollar volume coming in at $1.3 billion virtually equal to last year because price continued to increase at a modest 3.1 percent to $4,752 per acres. This suggests that the drop in activity has reached a trough even as price increases continue to slide. However, regional trends varied.

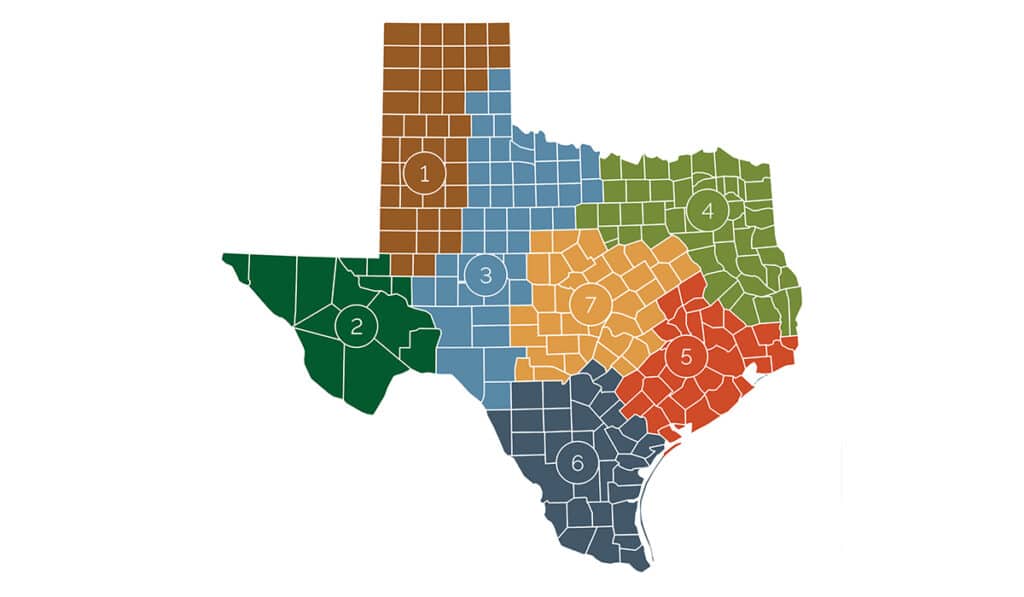

- Panhandle & South Plains. Third quarter prices in this region shot up 16.5 percent to $1,859 per acre but volume faltered, dropping 31.1 percent to 292 sales o f 43,631 acres, down 38.3 percent from a year ago. Total dollar volume dropped 28.0 percent to $81.1 million.

- Far West Texas. Price increased to $616 per acre a 14.1 percent increase. The region reported only 12 sales for the four-quarter period, down 21.0 percent. Typical size was 14,669 acres.

- West Texas. West Texas prices remained nearly unchanged, up only 0.4 percent to $2,475 per acre. The moderating prices resulted in sales volume slipping an insignificant 3.4 percent to 451 sales with a 41.1 percent increase in acres sold to a total of 81,415 acres. The increase in acres sold pushed total dollar volume up 41.7 percent to $201.7 million.

- Northeast Texas. Prices in this region continued strong increases, up 8.5 percent to $8,368 per acre. However, the higher prices resulted in only 837 sales do wn 28.5 percent. A total of 25,918 acres sold for an increase of 30.8 percent. The drop in volume resulted in a total dollar volume decline of 24.9 percent to $216.9 million.

- Gulf Coast–Brazos Bottom. Prices in this region inched up 2.1 percent to $9,803 per acre. Volume continued to slide a modest 2.8 percent to 460 sales with total dollar volume ebbed 6.2 percent to $169.8 million. Total acreage dropped 8.2 percent to 17,315 acres.

- South Texas. South of San Antonio prices inched down 2.3 percent to $5,934 per acre. Sales volume also ebbed do wn 12.0 percent to 294 sales recucing total dollar volume 14.8 percent to $138.8 million. Total acreage dropped 12.7 percent to 23,390 acres.

- Austin-Waco-Hill Country. Prices barely changed, increasing 0.4 percent to $7,269 per acre. The number of sales totaled of 936 transactions, down 2.0 percent. However, total dollar volume expanded 3.1 percent to $332.1 million. Total acres also rose a modest 2.7 percent to 45,690 acres.

The Future

Markets continue to exhibit weak demand with muted price increases possibly reflecting a flight to quality. However, the weakened price dynamics suggest that declining activity may have reached a bottom in some regions. While prices might weaken further, the decline could ignite an increase in activity in the year ahead.