This article is featured in the Summer 2025 issue of Texas LAND magazine. Click here to find out more.

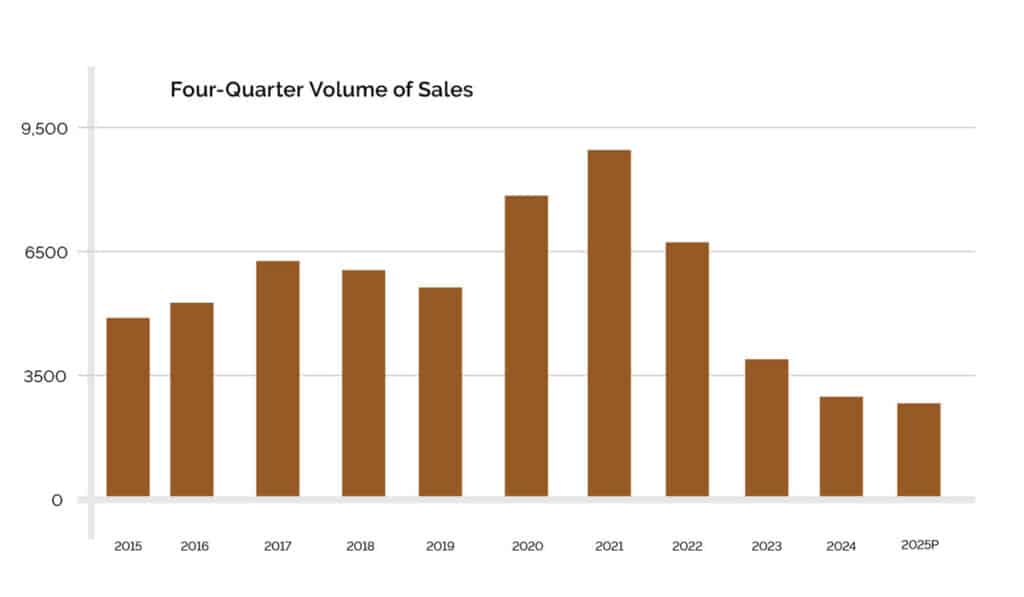

- Total Dollar Volume $1.28 Billion

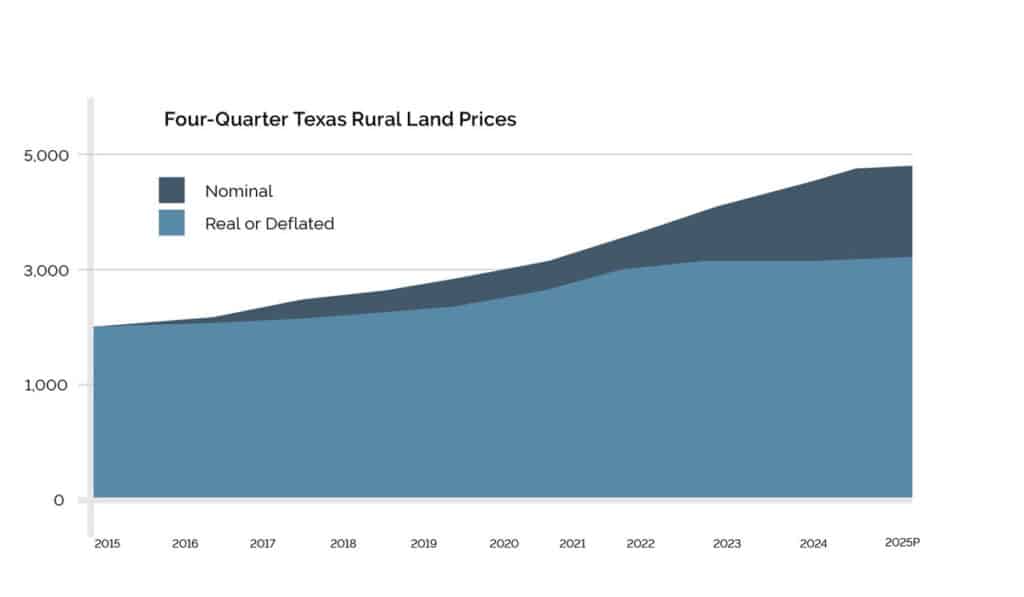

- Price Per Acres Increased to $4,810

- Sales Dropped from 2024 17%

- The Number of Acres Increased 277,222

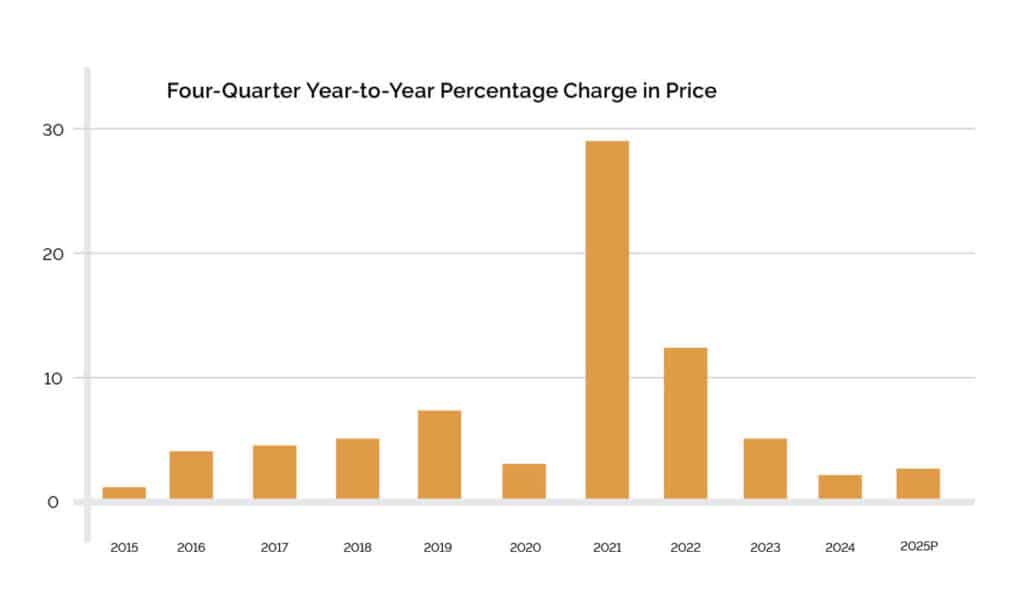

The decline in sales volume may be approaching a trough, with preliminary 2025 sales dropping only 17 percent from 2024 totals to 3,011 sales. Final reports should reduce that percentage as more data reaches the Real Estate Research Center. That volume amounts to about 36 percent of the 8,350 sales reported in 2021 but trails 2024 by only 410 sales. The preliminary acreage increased 1.80 percent to 277,222 acres. Total dollar volume inched up 4.16 percent from $1.28 billion to $1.33 billion. Price continued to increased 2 percent to $4,810 per acre. The increases in both acreage and total dollar volume suggest that the modest increase in prices has encouraged buyers to purchase more land.

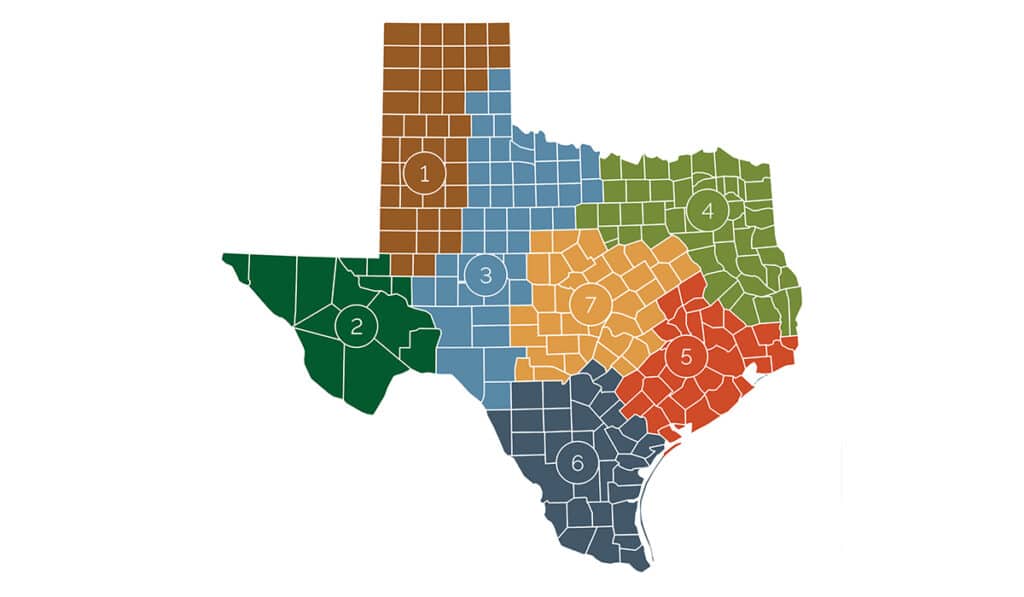

- Panhandle & South Plains. Prices in this region increased 4.9 percent to $1,848 per acre with the number of acres dropping nearly 10,000 acres to a total of 43,742 acres. However, the number of sales dropped 33.9 percent to 276 sales. Total dollar volume also slipped in this region, falling 15.0 percent to $80.8 million. The slow volume and dropping total dollar volume suggests that demand remains weak.

- Far West Texas. The meagre volume of sales, 12 over four quarters, yields little evidence of market trends in West Texas.

- West Texas. Buyers in this region drove prices higher while sales volume and total acres sold dropped. Transactions posted a strong price increase, up 13.3 percent to $2,672 per acre. The price climb accompanied a pronounced slip in volume to 423 sales, down 11.7 percent from 479 in the first quarter of 2024. The strong price impelled total dollar volume to $173.9 million, up 4.32 percent. These developments suggest that sales may have occurred disproportionately in better quality land.

- Northeast Texas. The 34.6 percent collapse in volume of sales yielded 690 transactions reported in the four quarters ending in 2025 Q1. Reporting problems may have contributed to this remarkable drop in activity. However, prices actually fell from 2024 quarter four through 2025 quarter 1 to $8,391, a 1.35 percent drop from 2024 first quarter. A total of 22,539 acres sold, a decline of 30.0 percent. The drop in reported sales pushed total dollar volume down 28.9 percent to $189.1 million.

- Gulf Coast–Brazos Bottom. Prices in this region continued to set new records, settling at $10,135 per acre, up 9.38 percent. Volume slipped down 7.00 percent to 452 sales. However, total dollar volume rose 10.0 percent to $183.5 million. Total acreage also rose 0.47 percent to 18,104 acres.

- South Texas. Buyers in this region shifted from high priced areas to more remote properties at lower prices. The shift induced a regional price drop of 6.71 percent to $5,842 per acre. At 272 sales in preliminary volume reports, activity across the region will likely remain steady when final reports are made. Total acreage ebbed 6.36 percent to 21,085 acres. The price drop and volume decline drove total dollar volume down 12.69 percent to $123.2 million.

- Austin-Waco-Hill Country. Prices remained steady, climbing 0.64 percent to $7,242 per acre. However, sales volume dropped 5.66 percent to 884 transactions. Total dollar volume slid by 14.48 percent to $297.2 million as total acres sank 14.04 percent to 41,039 acres.

The Future

Dry conditions ranging from moderate to exceptional drought plague much of Texas west of Interstate 35. Reservoirs in that area remain at very low levels going into a growing season. Water shortages may limit production if it does not rain. These drought conditions continue to aggravate disputes over water deliveries with both New Mexico and Mexico. Historically, drought has not significantly impacted land prices when rains finally ease the distress. Nevertheless, drought-stressed property lacks market appeal.

In general, markets appear to be probing for price levels that will induce buyers to leave the sidelines and pull the trigger. Markets will likely see price increases slide during 2025 until the volume of activity begins to increase.