This article is featured in the Spring 2021 issue of Texas LAND magazine. Click here to find out more.

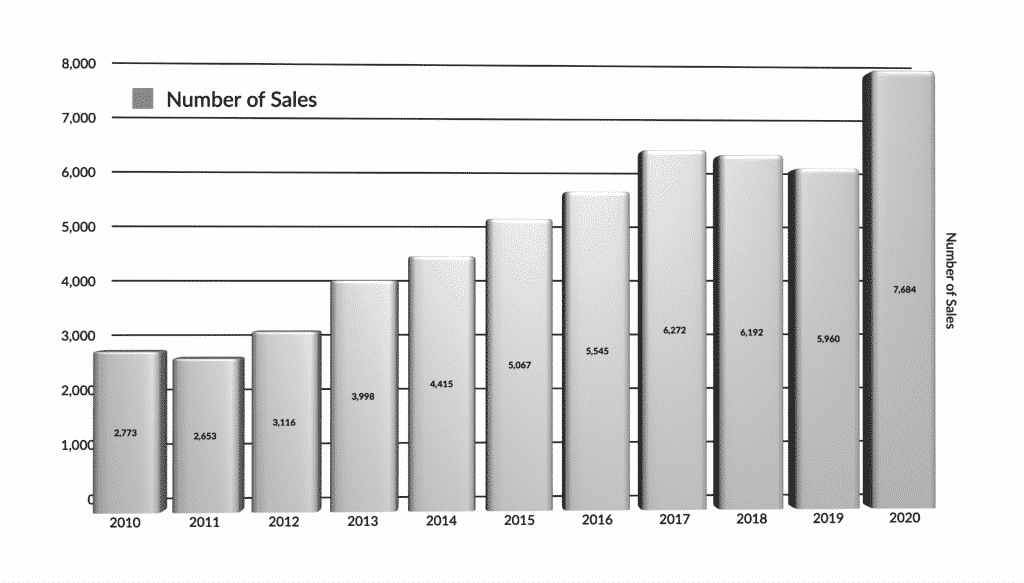

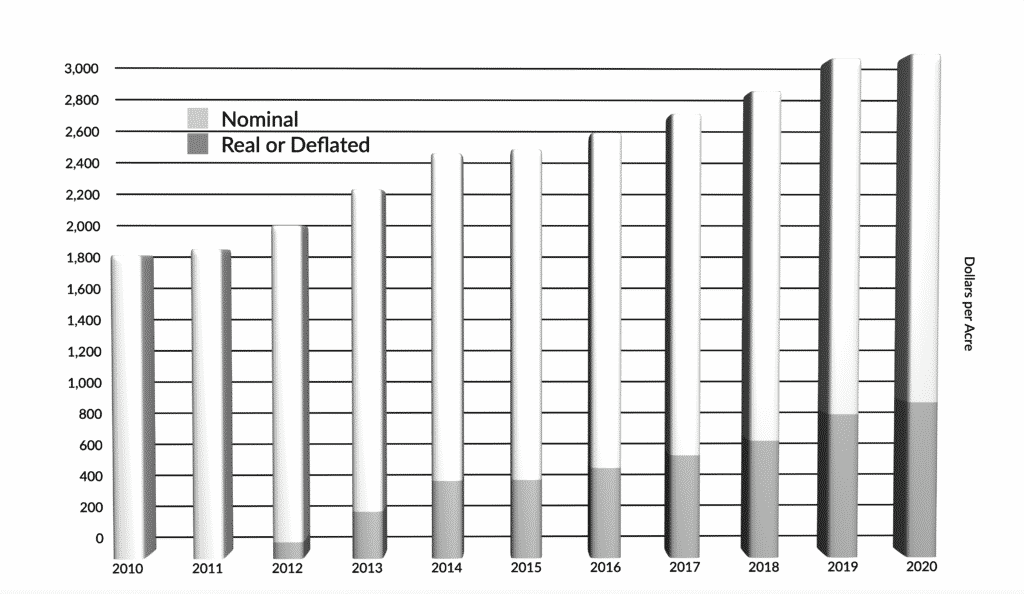

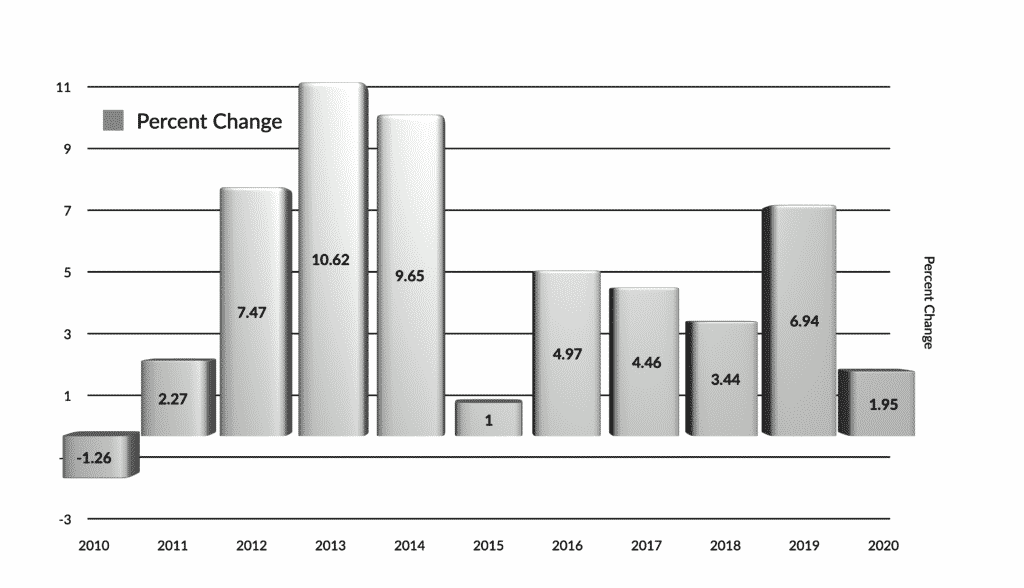

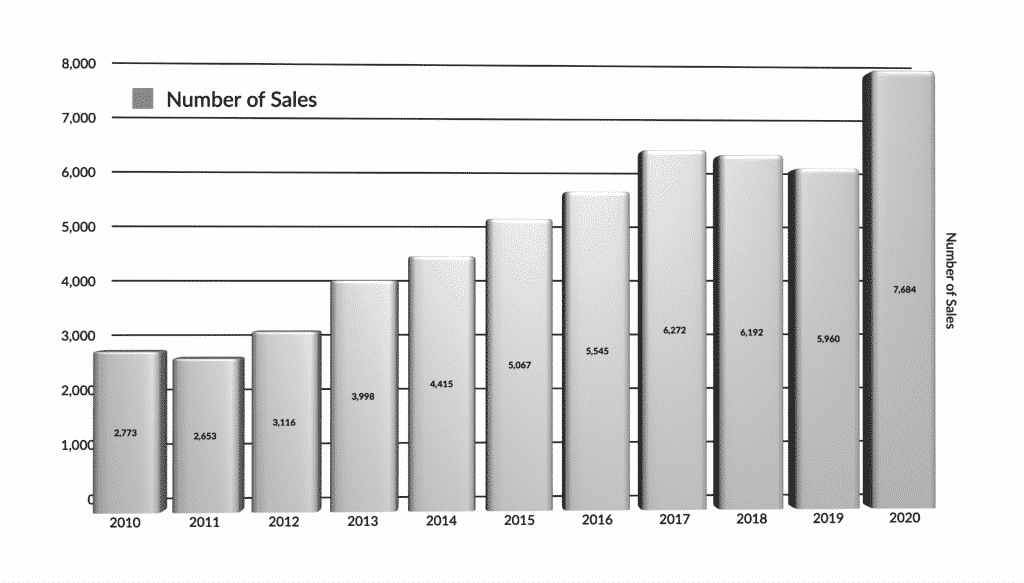

Activity in the fourth quarter produced a remarkable increase in transactions throughout most of Texas, expanding the statewide volume of sales by 28.93 percent to 7,684 sales. Two regions posted greater than a 38 percent increase in closed sales. This uptick in sales volume tends to confirm reports that buyers are seeking country getaways and places to invest funds in uncertain times. The Far West Texas Region actually sustained a sizable drop in activity (25.11 percent) as purchase from the oil and gas industry came to a halt owing to the oil price collapse. The South Texas Region where Eagle Ford oil play impacts the markets saw a muted 8.14 percent increase. Pushed by the uptick in demand, statewide prices increased 3.10 percent. The typical size fell -13.19 percent to 1,139 acres. Reflecting the strengthening market, the total dollar volume of $1.69 billion, for a record total, is up 17.63 percent. In all, 552,707 acres changed hands. These remarkable results reverse the second quarter pandemic-induced trend toward slowing markets and weaker prices. Taken together, the third and fourth quarter results signal a very active and rising market with strong demand for land in most areas of Texas.

Prices expanded in all regions except for the Panhandle and South Plains. The West Texas and Austin-Waco-Hill Country regions saw little growth in price, however they did experience remarkable increases in the number of sales. Only Far West Texas, impacted by falling oil prices, saw a decline in sales activity. The size of transaction fell everywhere except for South Texas. Total dollar volume retreated in Far West Texas, grew modestly in the Gulf Coast and Brazos Bottom, but expanded robustly everywhere else.

Panhandle and South Plains: Prices ranged sharply lower in this market with fourth quarter prices retreating -7.93 percent, a larger decline than the second quarter result. Observers suggest that an increase in the number of lower-priced grassland sales may have contributed to this drop. Hutchinson County was very active compared to historical norms while Ochiletree County registered far fewer transactions than normal. At $1,091 per acre, this price may have begun to reflect weak fundamentals in agricultural products markets as well as collapsing oil prices. The number of sales increased 23.89 percent from 2019 to 503 transactions. Total dollar volume grew 42.70 percent to $124.9 million. This indicated an active market with strong demand for all types of land. Size declined -9.12 percent to 381 acres while total acres shot up a substantial 55.00 percent to 114,484 acres.

Far West Texas: Land markets in this region have reflected the boom in oil prices and petroleum production for the past several years, driving prices to unprecedented levels. Collapsing oil prices and the COVID virus combined to weaken demand for land here as industrial demand for land collapsed. However, the small volume of sales did include some higher priced properties, expanding the regional price $930 per acre, a 16.40 percent increase from 2019 prices. However, total dollar volume fell -56.95 percent to $32.8 million. The number of sales fell -25.11 percent to a mere 26 transactions; size slipped -15.48 percent to 7,668 acres. Total acres transferred dropped -63.01 percent to 35,232 acres. Markets appear to be paralyzed in the face of the downturn in the oil industry. Terrell County was especially active.

West Texas: Buyers from the prosperous Dallas/Ft. Worth area migrated into this region searching for recreational and investment opportunities. This increase in demand drove up prices in the eastern counties of the region. At $1,657 per acre, prices rose only 0.36 percent. However, sales volume exploded by 40.69 percent to 892 sales. The typical size retreated -4.50 percent to 378 acres. Total dollar volume at $202.1 million increased a whopping 62.20 percent. At 121,947 acres, total acreage expanded 61.61 percent. This area exhibited strong market demand. Edwards, Taylor, and Young Counties were especially active.

Northeast Texas: Prices rose throughout this region from Fort Worth on the west through the Piney Woods along the Louisiana border. The regional price rose 3.99 percent to $5,036 per acre. The number of sales grew by 22.51 percent and total dollar volume expanded 32.61 percent to $408.6 million. The size of transaction contracted -3.21 percent to 116 acres. Total acreage sold grew 27.53 percent, rising to 81,137 acres. These market developments reflect strengthened conditions in the fourth quarter. Montague and Red River Counties were unusually quiet, while Henderson was very active.

Gulf Coast – Brazos Bottom: Despite the importance of the oil and gas industry to Houston, activity in this region remained active in the small end of the market. Total dollar volume managed to increase by 1.07 percent to $247.3 million with the number of sales ballooning 33.57 percent to 959 transactions. Regional price rose 8.30 percent to $6,887 per acre. The typical size dropped -2.60 percent settling at 147 acres. However, reflecting a move to smaller property sales, total acres transferred fell -6.68 percent to 35,910 acres. Wharton County accounted for a larger than normal number of sales in this region.

South Texas: South Texas market prices inched up 2.51 percent in the fourth quarter, settling at $3,919 per acre. Those results mark the fifth quarterly year-over-year price increase since the third quarter of 2019. Size also grew, rising by 5.44 percent to 297 acres. Even total dollar volume increased 10.38 percent to $196.8 million. At 611, the number of sales grew by a modest 8.14 percent. Total acres sold expanded by 7.68 percent to 50,212 acres. Atascosa and Nueces Counties were unusually active while Karnes remained unusually quiet.

Austin – Waco – Hill Country: In spite of the coronavirus and urban unrest, central Texas markets continued to prosper in 2020. Regional prices remained flat at a 0.95 percent increase to $4,146 per acre, and most market indicators remained positive despite the headwinds imposed by the coronavirus. Total dollar volume grew 26.06 percent to $473.8 million. The number of sales also expanded to a 38.98 percent increase at 2,364 sales. Size fell 1.93 percent to 209 acres. Total acres sold jumped 24.88 percent to 113,784 acres. Activity was unusually high in some of the lower priced counties in this region, confirming the hypothesized movement to the countryside.

Eastern States: The eastern states land markets posted mixed results with increasing numbers of sales in Alabama and Louisiana. However, contrary to trends elsewhere, Mississippi reported a drop in activity. Prices declined in Alabama but grew strongly in Mississippi. Louisiana saw prices rise, but that increase may have resulted from sales of substantially smaller properties. The typical Louisiana sale involved only 23 acres.

Alabama: Alabama prices dropped 1.93 percent to $2,605 per acre statewide. Prices grew in the three regions while declining in both the northwestern region. Volume of sales sagged in the northern regions but increased substantially in the southern regions resulting in a statewide increase of 20.72 percent to 1,200 sales. Total dollar volume slipped in two regions, remained steady in the northeast, while expanding dramatically in the southeastern region, eventually producing a -0.17 percent decline to $84.3 million statewide. Size remained little changed, falling -2.08 percent to 57 acres.

Alabama Regional Market Developments: Southwestern Alabama: In this region prices rose 1.75 percent to $2,213 per acre. However, size dropped -18.38 percent to 60 acres with an increasing sales volume that grew 21.21 percent to 400 transactions. Total dollar volume declined -16.88 percent to $29.8 million. This region saw an expansion of smaller sales.

Southeastern Alabama: Strengthened prices in this region resulted from a substantial increase in demand in this region. The price increased 7.49 percent to $2,636 per acre while the number of sales exploded, increasing 54.42 percent to 454 sales. Typical size expanded 12.39 percent to 61 acres. In addition, total dollar volume grew a substantial 44.09 percent to $31.9 million. Buyers appear to have descended on this region indicating strong demand through the end of the year.

Northwestern Alabama: Regional number of sales at 154 dropped -18.09 percent. Prices also collapsed, down -12.77 percent to $3,376 per acre. Retreating prices and falling volume combined to produce a total dollar volume drop of 14.10 percent to $9.2 million. Size did expand 13.50 percent to 48 acres explaining some of the price decline. These developments suggest a troubled market with buyers rejecting purchases at current prices.

Northeastern Alabama: The $2,941 per acre regional price grew 6.20 percent above 2019 prices. Size grew 19.16 percent to 52 acres. Sales volume dropped -9.89 percent to 164 sales. Total dollar volume remained nearly steady at 0.82 percent to $9.9 million. Markets in this region appear to be weak.

Louisiana: Third quarter Louisiana prices continued to rise, up 22.40 percent to $5,895 per acre. The number of sales increased a substantial 33.12 percent to 1,045 sales. In addition, total dollar volume increased 11.60 percent to $95.3 million. The size of transaction dropped -16.90 percent to 23 acres. This size suggests that Louisiana markets largely consist of sales of very small, high priced properties.

Mississippi: Bucking the trend toward more active markets, the volume of sales fell in all regions of Mississippi. That produced a statewide decline of -4.74 percent to 744 sales. The market concentrated on larger tracts at higher prices in the fourth quarter. Prices grew a substantial 7.01 percent to $2,844 per acre. However, regional experiences varied with the Hills Region posting a solid price increase while significantly weaker prices applied in the Prairie Region. Size increased a 10.97 percent to 76 acres. Total dollar volume at $78.3 million grew a modest 9.13 percent.

Mississippi Regional Market Developments: Delta: Total dollar volume remained steady, increasing 1.52 percent to $29.1 million while the number of sales remained nearly steady at 128 transactions, down -7.25 percent. The average size of transaction expanded 22.84 percent to 151 acres. Delta region prices dropped to $3,015 per acre down -4.65 percent. Taken together, these statistics portray a lackluster market.

Memphis/Jackson Influences: Urban influenced regions of Mississippi saw market prices advance slightly while activity continued to decline. Prices remained expanded, increasing 3.75 percent to $3,311 per acre. This small increase occurred even as tract size expanded to 46 acres, up 15.82 percent. At 91 sales, volume dropped -8.08 percent. In addition, total dollar volume increased 14.17 percent to $7.1 million. These developments reflect a strengthening market.

Prairie: Continuing the reversal begun in the first quarter, this region saw prices fall -1.90 percent to $2,441 per acre. The number of sales decreased by -8.57 percent to 96 sales. However, size grew 3.87 percent to 76 acres. Total dollar volume edged -8.02 percent lower to $9.1 million.

Hills: At $2,744 per acre, the Hills Region prices expanded a noteworthy 14.33 percent. Size grew 3.19 percent to 54 acres and sales volume remained nearly steady, dropping -2.28 percent to 429 sales. Total dollar volume at $33.1 million grew by 14.35 percent.

Fourth quarter developments posted very strong results given the turbulence roiling economies and societies plagued by the coronavirus. The unprecedented cessation of economic activity enacted an unprecedented toll throughout Texas and the southeast as numbers of transactions contracted in the second quarter as did total dollar volume. In normal times, those negative developments on a broad front would signal weakened prospects. However, the economic environment has radically changed from the moribund second quarter. Currently, market professionals report a remarkable flood of interest in land purchases.

Nevertheless, the path forward remains clouded in murky uncertainty. Many had anticipated that the severity of the pandemic would have abated by late summer. Because that did not happen, conditions have forced potential buyers to revise their expectations about the path forward. Fears of permanent layoffs, more bankruptcies, and evictions haunt their thinking. In addition, the unrest shaking cities also poses challenges for the future. Now, many see the current drive to vaccinate the world as the panacea anticipated for last fall. If the vaccines perform as hoped, the consensus is that the economy will come roaring back with rapid growth. However, the new strains of the virus spreading across the globe threaten a second wave of infections this spring. If that should transpire, further turmoil awaits in the future leading to reduced economic activity. Either scenario promises to spark feverish interest in rural properties either as a long-sought recreational getaway or as a haven protecting owners from the turmoil abounding in cities. These conditions suggest increased demand for land and higher land prices. Developments in the next two quarters will reveal the ultimate direction of future market realities.

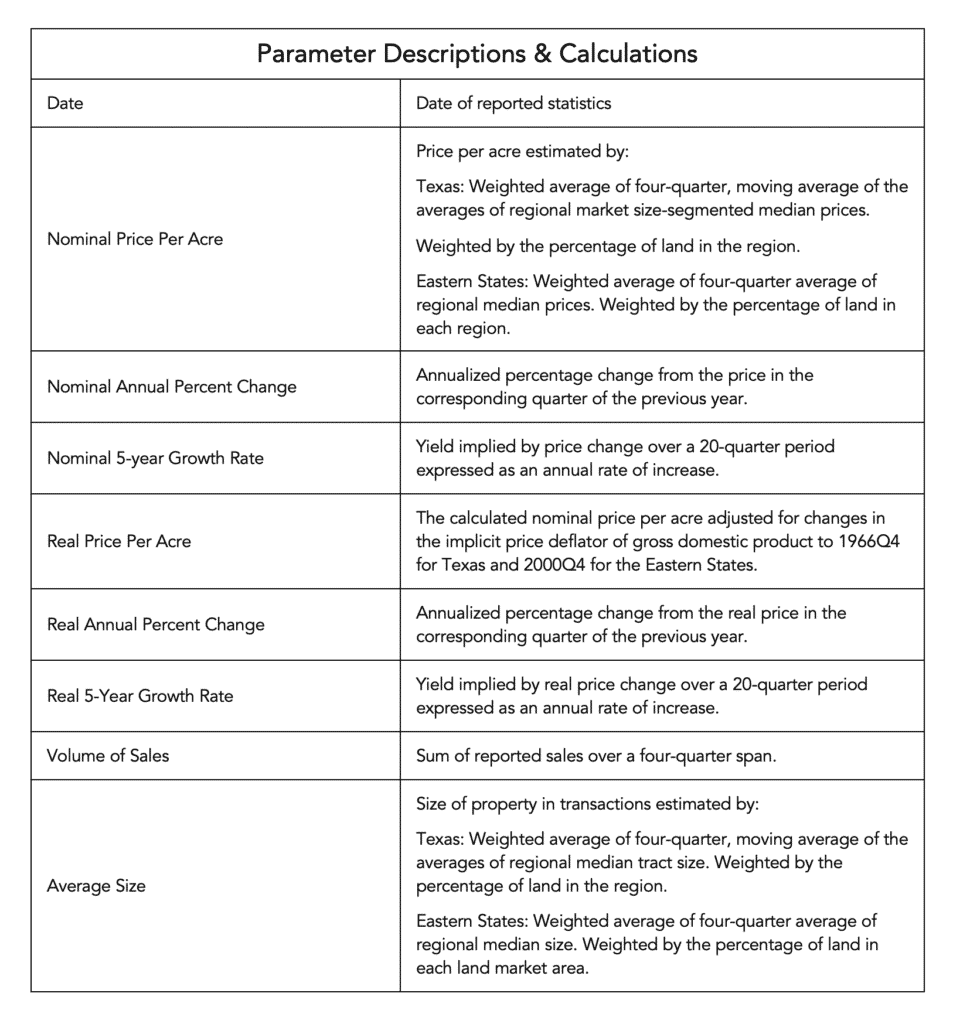

This report contains an analysis of land market developments in states served by the Farm Credit Bank of Texas. The analyses include price and market volume trends at local levels based on four-quarter moving averages of data reported by the local associations. Moving averages tend to minimize short-term fluctuations giving a long-term indication of market trends. The analysis primarily focuses on year-to-year annualized changes reported quarterly.