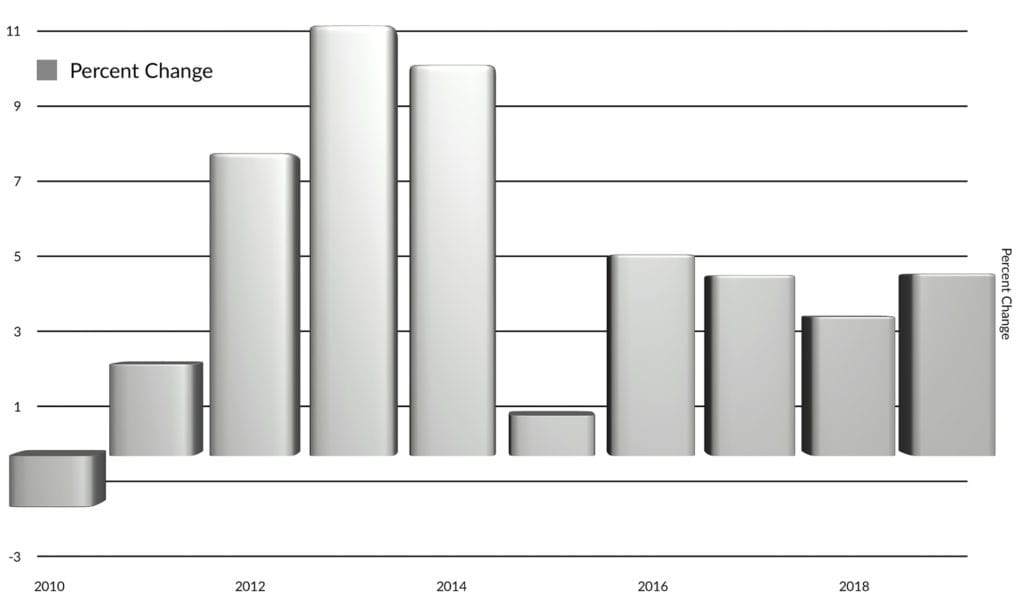

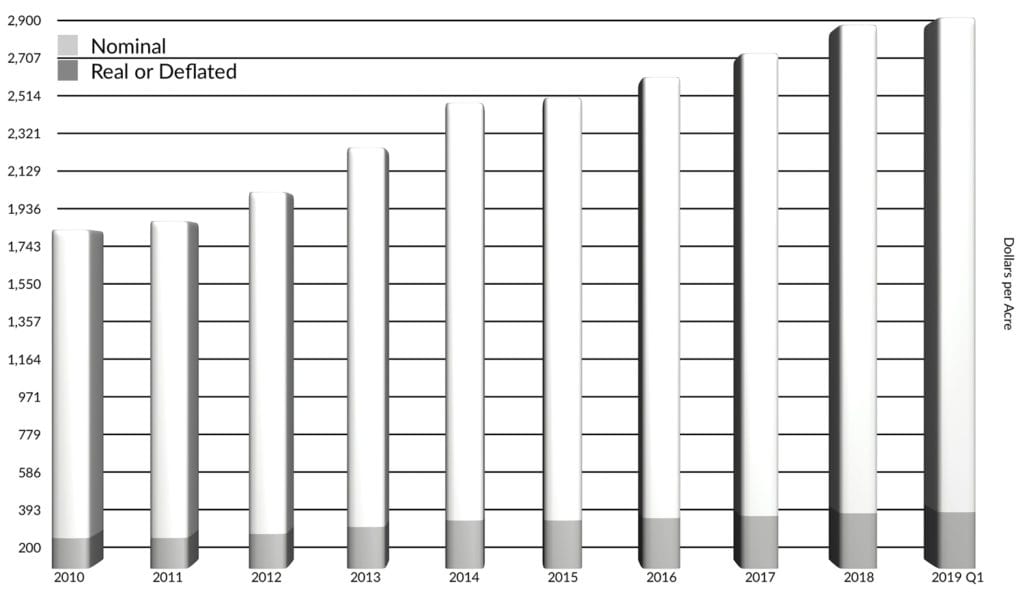

Texas statewide preliminary first quarter land prices soared to $2,814 per acre. That represents a 4.45 percent increase over first quarter 2018 prices and 1.25 percent growth since the fourth quarter of 2018. Increasing oil prices along with growing incomes spurred this performance despite rising Fed Funds interest rates throughout 2017 and 2018. However, the rate of land price growth moderated from the 5 to 6 percent range seen throughout 2018. Energy industry activity continued to support overall economic growth, feeding demand for recreational and investment properties. Prospects for the coming year point to continued price growth. At 5,686 reported sales, the preliminary reports retreated 10.7 percent behind 2018 first quarter totals. But, the 2019 inventory is a preliminary result. Total preliminary dollar volume was $1.20 billion. Buoyed by strong economic activity, 2019 markets appear to be set for solid growth.

Most regional markets posted solid to strong gains. However, with the feverish acquisition of land for sand mines waning, Far West Texas saw overall prices fall. Lacking sales of good irrigated cropland, South Texas regional prices also slipped.

Fed Funds increases at the end of 2018 caused turmoil in otherwise robust stock and bond markets, leading many to forecast recession ahead. As the first quarter of 2019 ends, the Fed has backed off plans to aggressively raise their rates, and those same pundits now see continued prosperity ahead. Political instability threatens to derail these sanguine forecasts with confrontations in Venezuela, continuing drama in North Korea and tightening sanctions on Iran threatening to upset the status quo. In addition, the political confrontation between the House and the Whitehouse suggest a crisis may lie ahead. This uncertainty may derail the current optimism. However, market participants have noted an absence of oil industry buyers in 2018 markets. Following their strongly profitable year with rising prices this spring may lead those individuals to provide another spurt in growth in the year ahead.